Form Vat-14 - Notice

ADVERTISEMENT

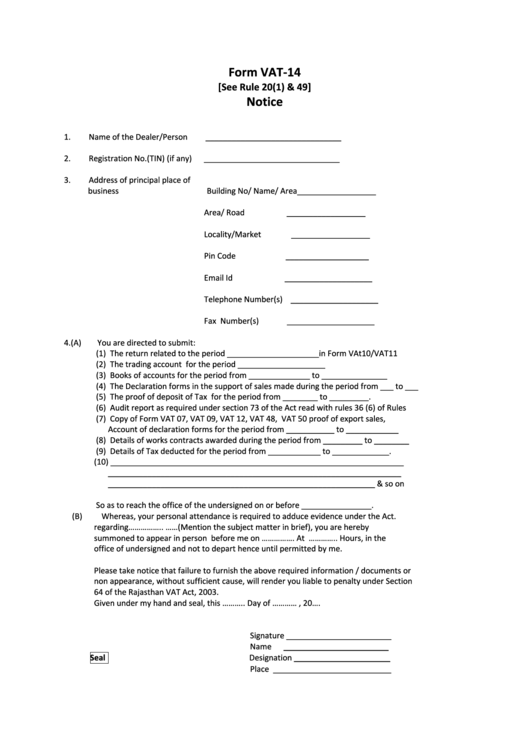

Form VAT-14

[See Rule 20(1) & 49]

Notice

1.

Name of the Dealer/Person

_______________________________

2.

Registration No.(TIN) (if any)

_______________________________

3.

Address of principal place of

business

Building No/ Name/ Area__________________

Area/ Road

__________________

Locality/Market

__________________

Pin Code

___________________

Email Id

____________________

Telephone Number(s) ____________________

Fax Number(s)

____________________

4.(A)

You are directed to submit:

(1) The return related to the period _____________________in Form VAt10/VAT11

(2) The trading account for the period ____________________

(3) Books of accounts for the period from ______________ to _______________

(4) The Declaration forms in the support of sales made during the period from ___ to ___

(5) The proof of deposit of Tax for the period from ________ to _________.

(6) Audit report as required under section 73 of the Act read with rules 36 (6) of Rules

(7) Copy of Form VAT 07, VAT 09, VAT 12, VAT 48, VAT 50 proof of export sales,

Account of declaration forms for the period from ___________ to ____________

(8) Details of works contracts awarded during the period from _________ to ________

(9) Details of Tax deducted for the period from ____________ to _____________.

(10) ___________________________________________________________________

___________________________________________________________________

_____________________________________________________________ & so on

So as to reach the office of the undersigned on or before ________________.

(B)

Whereas, your personal attendance is required to adduce evidence under the Act.

regarding…………….. ……(Mention the subject matter in brief), you are hereby

summoned to appear in person before me on ……………. At ………….. Hours, in the

office of undersigned and not to depart hence until permitted by me.

Please take notice that failure to furnish the above required information / documents or

non appearance, without sufficient cause, will render you liable to penalty under Section

64 of the Rajasthan VAT Act, 2003.

Given under my hand and seal, this ……….. Day of ………… , 20….

Signature ________________________

Name

________________________

Seal

Designation ______________________

Place ___________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1