Page 5

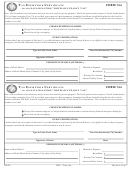

50. If the issuer has included an affirmative statement for line 49, has the issuer included a detailed description of the portion of such

comprehensive procedures which relate to the violation which is the subject of the TEB VCAP request identifying: 1) the authorized

person(s) that adopted the procedures; 2) the officer(s) with responsibility for monitoring compliance; 3) the frequency of compliance

check activities; 4) the nature of the compliance check activities undertaken; 5) and the date such procedures were originally

adopted and subsequently updated (if applicable)? IRM 7.2.3.2.1(3)

Yes

N/A

Page number

51. If the issuer has included an affirmative statement for line 49, has the issuer submitted information demonstrating that the issuer

had, either prior to the date of the violation, adopted “sufficient written procedures”, to ensure post-issuance compliance with federal

tax law requirements; or, after the violation, implemented such procedures and both timely identified the violation following such

implementation and submitted its request no later than 90 days after such identification? For purposes of this question, “sufficient

written procedures” must specify: the official with monitoring compliance responsibility; the frequency of at least annual compliance

checks; the nature of the compliance activities required to be undertaken; the procedures used to timely identify and elevate

resolution of a violation when it occurs, or is expected to occur; procedures for the retention of records material to substantiate

federal tax law compliance; and, an awareness of the availability of TEB VCAP and other remedial actions to resolve violations. A

mere reference to the bond documents is generally insufficient. IRM 7.2.3.4.4

Yes

N/A

Page number

Issuer Approval & Signature

Under penalties of perjury, I declare that I have examined this submission, including accompanying documents and statements, and to

the best of my knowledge and belief, the submission contains all the relevant facts relating to the request, and such facts are true,

correct, and complete

Signature of Official of Issuer

Name of Official of Issuer

Date signed

Note: TEB will only accept facts submitted by a party other than the issuer (e.g. conduit borrower, trustee) under penalties of perjury if

the issuer also certifies under penalties of perjury that to the best of the issuer’s knowledge that such facts are true and accurate. If the

issuer wishes to have another party submit facts under penalty of perjury, attached a separate penalty of perjury statement.

IRM 7.2.3.1.2(4)

14429

Catalog Number 60719A

Form

(3-2013)

1

1 2

2 3

3 4

4 5

5