3

Form 1028 (Rev. 9-2006)

Page

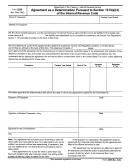

Part III

Activities and Operational Information (Continued)

15

Explain the requirements for membership in the association.

16

Federated cooperatives only:

a

Are all the association’s member cooperatives exempt under section 521?

Yes

No

b

If “No,” do the nonexempt member cooperatives have the same annual accounting period as the

association’s?

Yes

No

c

If “No,” to 16b, check the method below that the association used, or will use, to provide a common or comparable unit of

time for analyzing and evaluating its operations and those of its members.

Note: Methods listed below do not apply to the filing of returns or the manner in which operating results are reported by a

federated cooperative and its members.

1.

Method 1—The association uses the operations of members for those months that correspond to the months that

make up its tax year.

2.

Method 2—The association uses the tax years of members that end within its tax year.

3.

Method other than 1 or 2 above (explain)

Current tax

17

Value of agricultural products marketed or handled

3 prior tax years

year

for: (See instructions.)

(a) From

(b)

(c)

(d)

to

*a

Members—

1.

Actually produced by members

2.

Not actually produced by members but

marketed by them through the association

b

Nonmembers—

1.

Actually produced by nonmembers

2.

Not actually produced by nonmembers but

marketed by them through the association

c

Nonproducers (purchased from nonproducers for

marketing by the association)

18

Value of supplies and equipment purchased for or

sold to: (See instructions.)

*a

Members who were producers

b

Nonmembers who were producers

c

Members and nonmembers who were not producers

19

Amount of business done with the United States

Government or any of its agencies

20

Does the association plan to do business with the United States Government or any of its agencies in the future?

Yes

No

21a Were all of the net earnings (after payment of dividends, if any, on capital stock) for the years shown on

lines 17–19 distributed as patronage dividends? (See instructions for lines 17–19.)

Yes

No

b

If “No,” were undistributed net earnings apportioned on the records to all patrons on a patronage basis?

Yes

No

22a Has the organization operated in a manner consistent with the information given since the date formed?

Yes

No

b

If “No,” state the changes that have occurred and dates of the changes.

*If it is necessary to own one or more shares of stock in order to become a member, include on lines 17a and 18a only the amount

of business transacted with persons actually owning the required number of shares.

1028

Form

(Rev. 9-2006)

1

1 2

2 3

3 4

4