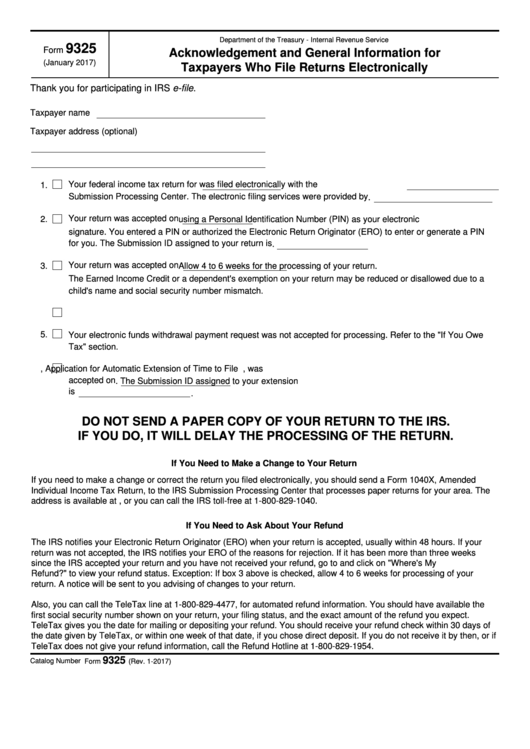

Department of the Treasury - Internal Revenue Service

9325

Form

Acknowledgement and General Information for

(January 2017)

Taxpayers Who File Returns Electronically

Thank you for participating in IRS e-file.

Taxpayer name

Taxpayer address (optional)

Your federal income tax return for

was filed electronically with the

1.

Submission Processing Center. The electronic filing services were provided by

.

Your return was accepted on

2.

using a Personal Identification Number (PIN) as your electronic

signature. You entered a PIN or authorized the Electronic Return Originator (ERO) to enter or generate a PIN

for you. The Submission ID assigned to your return is

.

Your return was accepted on

3.

Allow 4 to 6 weeks for the processing of your return.

The Earned Income Credit or a dependent's exemption on your return may be reduced or disallowed due to a

child's name and social security number mismatch.

4.

Your electronic funds withdrawal payment request was accepted for processing.

5.

Your electronic funds withdrawal payment request was not accepted for processing. Refer to the "If You Owe

Tax" section.

6.

Your Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, was

accepted on

. The Submission ID assigned to your extension

is

.

DO NOT SEND A PAPER COPY OF YOUR RETURN TO THE IRS.

IF YOU DO, IT WILL DELAY THE PROCESSING OF THE RETURN.

If You Need to Make a Change to Your Return

If you need to make a change or correct the return you filed electronically, you should send a Form 1040X, Amended U.S.

Individual Income Tax Return, to the IRS Submission Processing Center that processes paper returns for your area. The

address is available at , or you can call the IRS toll-free at 1-800-829-1040.

If You Need to Ask About Your Refund

The IRS notifies your Electronic Return Originator (ERO) when your return is accepted, usually within 48 hours. If your

return was not accepted, the IRS notifies your ERO of the reasons for rejection. If it has been more than three weeks

since the IRS accepted your return and you have not received your refund, go to and click on "Where's My

Refund?" to view your refund status. Exception: If box 3 above is checked, allow 4 to 6 weeks for processing of your

return. A notice will be sent to you advising of changes to your return.

Also, you can call the TeleTax line at 1-800-829-4477, for automated refund information. You should have available the

first social security number shown on your return, your filing status, and the exact amount of the refund you expect.

TeleTax gives you the date for mailing or depositing your refund. You should receive your refund check within 30 days of

the date given by TeleTax, or within one week of that date, if you chose direct deposit. If you do not receive it by then, or if

TeleTax does not give your refund information, call the Refund Hotline at 1-800-829-1954.

9325

Catalog Number 12901K

Form

(Rev. 1-2017)

1

1 2

2