I

I

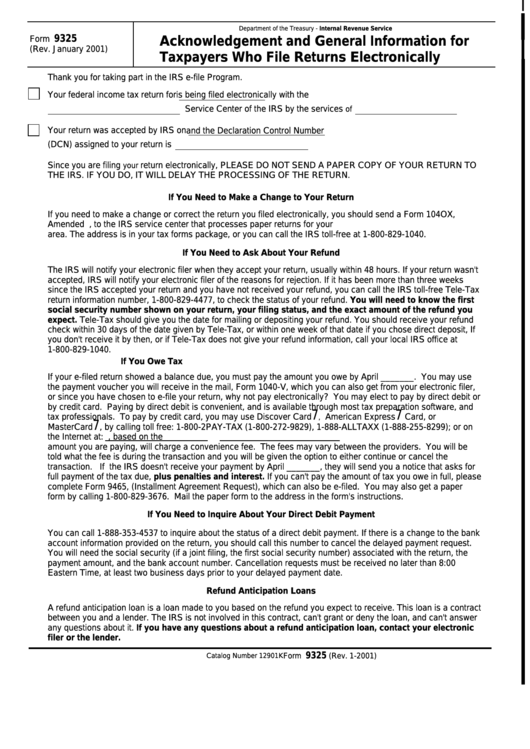

Department of the Treasury - Internal Revenue Service

9325

Form

Acknowledgement and General Information for

I

(Rev. January 2001)

Taxpayers Who File Returns Electronically

Thank you for taking part in the IRS e-file Program.

Your federal income tax return for

is being filed electronically with the

Service Center of the IRS by the services

of

Your return was accepted by IRS on

and the Declaration Control Number

(DCN) assigned to your return is

Since you are filing

return electronically, PLEASE DO NOT SEND A PAPER COPY OF YOUR RETURN TO

your

THE IRS. IF YOU DO, IT WILL DELAY THE PROCESSING OF THE RETURN.

If You Need to Make a Change to Your Return

If you need to make a change or correct the return you filed electronically, you should send a Form 104OX,

Amended U.S. Individual Income Tax Return, to the IRS service center that processes paper returns for your

area. The address is in your tax forms package, or you can call the IRS toll-free at 1-800-829-1040.

If You Need to Ask About Your Refund

The IRS will notify your electronic filer when they accept your return, usually within 48 hours. If your return wasn't

accepted, IRS will notify your electronic filer of the reasons for rejection. If it has been more than three weeks

since the IRS accepted your return and you have not received your refund, you can call the IRS toll-free Tele-Tax

return information number, 1-800-829-4477, to check the status of your refund. You will need to know the first

social security number shown on your return, your filing status, and the exact amount of the refund you

expect. Tele-Tax should give you the date for mailing or depositing your refund. You should receive your refund

check within 30 days of the date given by Tele-Tax, or within one week of that date if you chose direct deposit, If

you don't receive it by then, or if Tele-Tax does not give your refund information, call your local IRS office at

1-800-829-1040.

If You Owe Tax

If your e-filed return showed a balance due, you must pay the amount you owe by April _______. You may use

the payment voucher you will receive in the mail, Form 1040-V, which you can also get from your electronic filer,

or since you have chosen to e-file your return, why not pay electronically? You may elect to pay by direct debit or

by credit card. Paying by direct debit is convenient, and is available through most tax preparation software, and

7

7

tax professionals. To pay by credit card, you may use Discover Card

American Express

Card, or

,

7

MasterCard

, by calling toll free: 1-800-2PAY-TAX (1-800-272-9829), 1-888-ALLTAXX (1-888-255-8299); or on

the Internet at: or The service providers, based on the

amount you are paying, will charge a convenience fee. The fees may vary between the providers. You will be

told what the fee is during the transaction and you will be given the option to either continue or cancel the

transaction. If the IRS doesn't receive your payment by April _______, they will send you a notice that asks for

full payment of the tax due, plus penalties and interest. If you can't pay the amount of tax you owe in full, please

complete Form 9465, (Installment Agreement Request), which can also be e-filed. You may also get a paper

form by calling 1-800-829-3676. Mail the paper form to the address in the form's instructions.

If You Need to Inquire About Your Direct Debit Payment

You can call 1-888-353-4537 to inquire about the status of a direct debit payment. If there is a change to the bank

account information provided on the return, you should call this number to cancel the delayed payment request.

You will need the social security (if a joint filing, the first social security number) associated with the return, the

payment amount, and the bank account number. Cancellation requests must be received no later than 8:00 p.m.

Eastern Time, at least two business days prior to your delayed payment date.

Refund Anticipation Loans

A refund anticipation loan is a loan made to you based on the refund you expect to receive. This loan is a contract

between you and a lender. The IRS is not involved in this contract, can't grant or deny the loan, and can't answer

any questions about it. If you have any questions about a refund anticipation loan, contact your electronic

filer or the lender.

9325

Catalog Number 12901K

Form

(Rev. 1-2001)

1

1