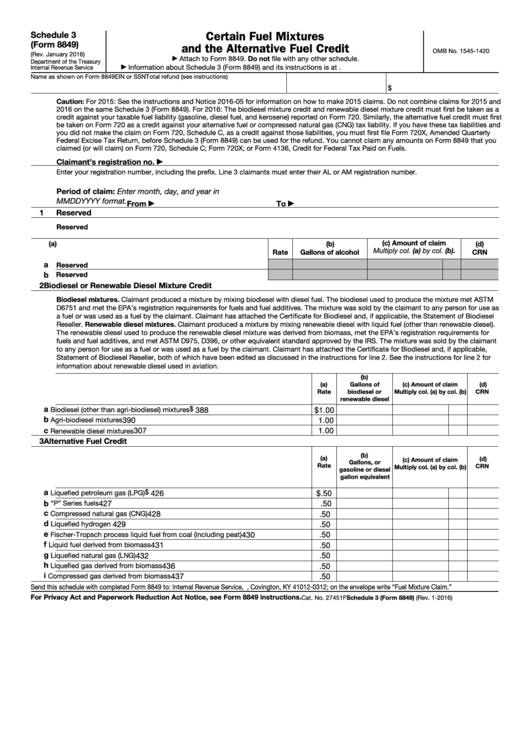

Certain Fuel Mixtures

Schedule 3

(Form 8849)

and the Alternative Fuel Credit

OMB No. 1545-1420

(Rev. January 2016)

Attach to Form 8849. Do not file with any other schedule.

▶

Department of the Treasury

Information about Schedule 3 (Form 8849) and its instructions is at

Internal Revenue Service

▶

Name as shown on Form 8849

EIN or SSN

Total refund (see instructions)

$

Caution: For 2015: See the instructions and Notice 2016-05 for information on how to make 2015 claims. Do not combine claims for 2015 and

2016 on the same Schedule 3 (Form 8849). For 2016: The biodiesel mixture credit and renewable diesel mixture credit must first be taken as a

credit against your taxable fuel liability (gasoline, diesel fuel, and kerosene) reported on Form 720. Similarly, the alternative fuel credit must first

be taken on Form 720 as a credit against your alternative fuel or compressed natural gas (CNG) tax liability. If you have these tax liabilities and

you did not make the claim on Form 720, Schedule C, as a credit against those liabilities, you must first file Form 720X, Amended Quarterly

Federal Excise Tax Return, before Schedule 3 (Form 8849) can be used for the refund. You cannot claim any amounts on Form 8849 that you

claimed (or will claim) on Form 720, Schedule C; Form 720X; or Form 4136, Credit for Federal Tax Paid on Fuels.

Claimant’s registration no.

▶

Enter your registration number, including the prefix. Line 3 claimants must enter their AL or AM registration number.

Period of claim: Enter month, day, and year in

MMDDYYYY format.

From

To

▶

▶

1

Reserved

Reserved

(c) Amount of claim

(a)

(b)

(d)

Rate

Gallons of alcohol

CRN

Multiply col. (a) by col. (b).

a

Reserved

b

Reserved

2

Biodiesel or Renewable Diesel Mixture Credit

Biodiesel mixtures. Claimant produced a mixture by mixing biodiesel with diesel fuel. The biodiesel used to produce the mixture met ASTM

D6751 and met the EPA’s registration requirements for fuels and fuel additives. The mixture was sold by the claimant to any person for use as

a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, the Statement of Biodiesel

Reseller. Renewable diesel mixtures. Claimant produced a mixture by mixing renewable diesel with liquid fuel (other than renewable diesel).

The renewable diesel used to produce the renewable diesel mixture was derived from biomass, met the EPA’s registration requirements for

fuels and fuel additives, and met ASTM D975, D396, or other equivalent standard approved by the IRS. The mixture was sold by the claimant

to any person for use as a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable,

Statement of Biodiesel Reseller, both of which have been edited as discussed in the instructions for line 2. See the instructions for line 2 for

information about renewable diesel used in aviation.

(b)

(a)

Gallons of

(c) Amount of claim

(d)

Rate

biodiesel or

Multiply col. (a) by col. (b)

CRN

renewable diesel

a

$

$1.00

388

Biodiesel (other than agri-biodiesel) mixtures

b

Agri-biodiesel mixtures

1.00

390

c

1.00

307

Renewable diesel mixtures

3

Alternative Fuel Credit

(b)

(a)

(d)

(c) Amount of claim

Gallons, or

Rate

CRN

Multiply col. (a) by col. (b)

gasoline or diesel

gallon equivalent

a

$

$.50

426

Liquefied petroleum gas (LPG)

b

“P” Series fuels

.50

427

c

Compressed natural gas (CNG)

.50

428

d

Liquefied hydrogen

.50

429

e

.50

430

Fischer-Tropsch process liquid fuel from coal (including peat)

f

Liquid fuel derived from biomass

.50

431

g

Liquefied natural gas (LNG)

.50

432

h

Liquefied gas derived from biomass

.50

436

i

.50

437

Compressed gas derived from biomass

Send this schedule with completed Form 8849 to: Internal Revenue Service, P.O. Box 312, Covington, KY 41012-0312; on the envelope write “Fuel Mixture Claim.”

For Privacy Act and Paperwork Reduction Act Notice, see Form 8849 instructions.

Cat. No. 27451F

Schedule 3 (Form 8849) (Rev. 1-2016)

1

1 2

2 3

3