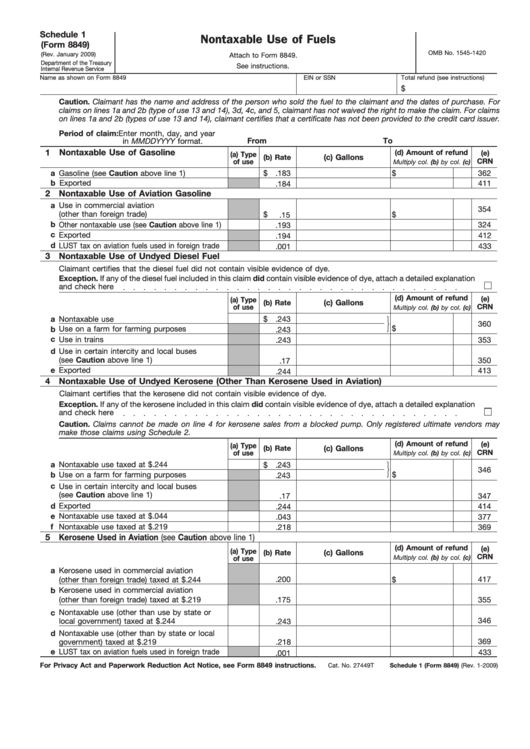

Schedule 1

Nontaxable Use of Fuels

(Form 8849)

OMB No. 1545-1420

(Rev. January 2009)

Attach to Form 8849.

Department of the Treasury

See instructions.

Internal Revenue Service

Name as shown on Form 8849

EIN or SSN

Total refund (see instructions)

$

Caution. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. For

claims on lines 1a and 2b (type of use 13 and 14), 3d, 4c, and 5, claimant has not waived the right to make the claim. For claims

on lines 1a and 2b (types of use 13 and 14), claimant certifies that a certificate has not been provided to the credit card issuer.

Period of claim: Enter month, day, and year

From

To

in MMDDYYYY format.

1 Nontaxable Use of Gasoline

(d) Amount of refund

(e)

(a) Type

(c) Gallons

(b) Rate

of use

CRN

Multiply col. (b) by col. (c)

a

Gasoline (see Caution above line 1)

362

$

.183

$

b Exported

.184

411

2

Nontaxable Use of Aviation Gasoline

a

Use in commercial aviation

354

(other than foreign trade)

$

.15

$

b

Other nontaxable use (see Caution above line 1)

324

.193

c

Exported

412

.194

d

LUST tax on aviation fuels used in foreign trade

433

.001

3

Nontaxable Use of Undyed Diesel Fuel

Claimant certifies that the diesel fuel did not contain visible evidence of dye.

Exception. If any of the diesel fuel included in this claim did contain visible evidence of dye, attach a detailed explanation

and check here

(d) Amount of refund

(e)

(a) Type

(c) Gallons

(b) Rate

of use

CRN

Multiply col. (b) by col. (c)

a

Nontaxable use

$

.243

360

$

b

Use on a farm for farming purposes

.243

c

Use in trains

353

.243

d

Use in certain intercity and local buses

(see Caution above line 1)

350

.17

e

Exported

413

.244

4

Nontaxable Use of Undyed Kerosene (Other Than Kerosene Used in Aviation)

Claimant certifies that the kerosene did not contain visible evidence of dye.

Exception. If any of the kerosene included in this claim did contain visible evidence of dye, attach a detailed explanation

and check here

Caution. Claims cannot be made on line 4 for kerosene sales from a blocked pump. Only registered ultimate vendors may

make those claims using Schedule 2.

(d) Amount of refund

(e)

(a) Type

(b) Rate

(c) Gallons

CRN

of use

Multiply col. (b) by col. (c)

a

Nontaxable use taxed at $.244

.243

$

346

b

Use on a farm for farming purposes

$

.243

c

Use in certain intercity and local buses

(see Caution above line 1)

.17

347

Exported

d

.244

414

e

Nontaxable use taxed at $.044

377

.043

Nontaxable use taxed at $.219

f

.218

369

5

Kerosene Used in Aviation (see Caution above line 1)

(d) Amount of refund

(e)

(a) Type

(b) Rate

(c) Gallons

CRN

Multiply col. (b) by col. (c)

of use

a

Kerosene used in commercial aviation

.200

$

417

(other than foreign trade) taxed at $.244

b

Kerosene used in commercial aviation

(other than foreign trade) taxed at $.219

.175

355

c

Nontaxable use (other than use by state or

346

local government) taxed at $.244

.243

d

Nontaxable use (other than by state or local

369

government) taxed at $.219

.218

e

LUST tax on aviation fuels used in foreign trade

433

.001

For Privacy Act and Paperwork Reduction Act Notice, see Form 8849 instructions.

Cat. No. 27449T

Schedule 1 (Form 8849) (Rev. 1-2009)

1

1 2

2 3

3 4

4