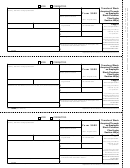

Instructions for Employee

Box 3. Shows the fair market value (FMV) per share on the

You have received this form because (1) your employer (or its

transfer agent) has recorded a first transfer of legal title of

date the option to purchase the stock was granted to you.

stock you acquired pursuant to your exercise of an option

Box 4. Shows the FMV per share on the date you exercised

granted under an employee stock purchase plan, and (2) the

the option to purchase the stock.

exercise price was less than 100% of the value of the stock on

Box 5. Shows the price paid per share on the date you

the date shown in box 1 or was not fixed or determinable on

exercised the option to purchase the stock.

that date.

Box 6. Shows the number of shares to which legal title was

No income is recognized when you exercise an option

transferred by you.

under an employee stock purchase plan. However, you must

Box 7. Shows the date legal title of the shares was first

recognize (report) gain or loss on your tax return for the year in

transferred by you.

which you sell or otherwise dispose of the stock. Keep this

form and use it to figure the gain or loss. For more information,

Box 8. If the exercise price per share was not fixed or

see Pub. 525.

determinable on the date entered in box 1, box 8 shows the

exercise price per share determined as if the option was

Account number. May show an account or other unique

exercised on the date in box 1. If the exercise price per share

number your employer or transfer agent assigned to

was fixed or determinable on the date shown in box 1, then

distinguish your account.

box 8 will be blank.

Box 1. Shows the date the option to purchase the stock was

Future developments. For the latest information about

granted to you.

developments related to Form 3922 and its instructions, such

Box 2. Shows the date you exercised the option to purchase

as legislation enacted after they were published, go to

the stock.

1

1 2

2 3

3 4

4 5

5