Missouri Tax I.D. Number

Section 1 Total Cost of Production

A. Direct Material . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A

B. Direct Labor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B

C. Overhead Expenses

1. Plant Equipment-Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C1

2. Plant Equipment-Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C2

3. Plant Equipment-Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C3

4. Plant Building Rent or Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . C4

5. Compensation Insurance or Similar Cost . . . . . . . . . . . . . . . . . . . . . . . C5

6. Indirect Labor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C6

7. Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C7

8. List Other Expenses __________________________________ . . . . . C8

__________________________________________________

__________________________________________________

__________________________________________________

$ 0.00

Total Overhead Expenses (Total C1–C8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C

$ 0.00

D. Total Cost of Production (Total A, B and C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

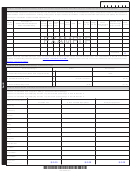

1. Total cost of electrical energy used in operation (Part B, Section 3, Column 1) . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Total cost of producing product in exempt operation (Part C, Line D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. Total cost of electrical energy used directly in exempt operation (Part B, Section 3, Column 3). . . . . . . . . . . .

3

4. Total production costs less electrical energy used in production in exempt operation (Line 2 minus Line 3) . . .

4

5. Ten percent of Line 4 (Line 4 multiplied by .10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. Percentage of electrical energy used in production to total cost of production exclusive of electrical energy

so used (Line 3 divided by Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

If at any time you no longer qualify for this exemption, it is your responsibility to notify

your utility supplier, withdraw your exemption, and remit the appropriate tax to the state.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I declare that I have direct

control, supervision or responsibility for completing this application. Declaration of preparer (other than taxpayer) is based on all information of which he or

she has any knowledge. As provided in

Chapter 143,

RSMo, a penalty of up to $500 shall be imposed on any individual who files a frivolous return.

Signature

Title

Printed Name

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Form-1749E-10 (Revised 08-2015)

Mail to: Taxation Division

Phone: (573) 751-2836

P.O. Box 358

Fax: (573) 522-1271

Visit

dor.mo.gov/business/sales/

Jefferson City, MO 65105-0358

E-mail:

salestaxexemptions@dor.mo.gov

for additional information.

*14015030001*

14015030001

1

1 2

2 3

3