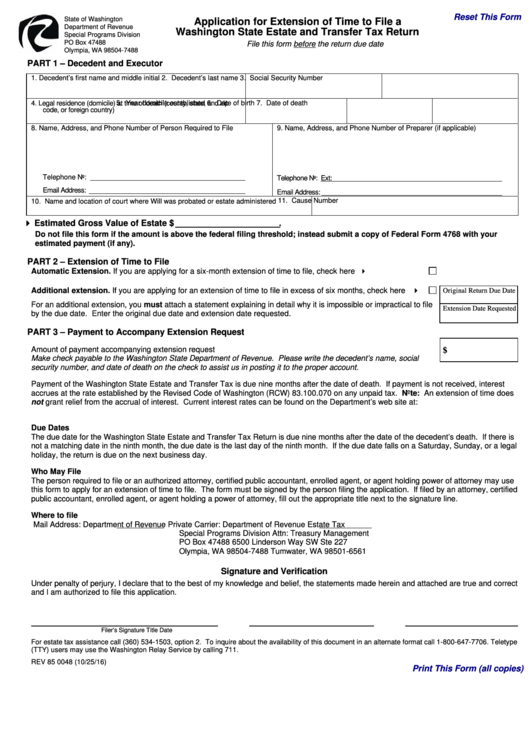

Reset This Form

State of Washington

Application for Extension of Time to File a

Department of Revenue

Washington State Estate and Transfer Tax Return

Special Programs Division

PO Box 47488

File this form before the return due date

Olympia, WA 98504-7488

PART 1 – Decedent and Executor

1. Decedent’s first name and middle initial

2. Decedent’s last name

3. Social Security Number

4. Legal residence (domicile) at time of death (county, state, and zip

5. Year domicile established

6. Date of birth

7. Date of death

code, or foreign country)

8. Name, Address, and Phone Number of Person Required to File

9. Name, Address, and Phone Number of Preparer (if applicable)

Telephone No:

Telephone No:

Ext:

Email Address:

Email Address:

11. Cause Number

10. Name and location of court where Will was probated or estate administered

Estimated Gross Value of Estate $

.

Do not file this form if the amount is above the federal filing threshold; instead submit a copy of Federal Form 4768 with your

estimated payment (if any).

PART 2 – Extension of Time to File

Automatic Extension. If you are applying for a six-month extension of time to file, check here .............................

Additional extension. If you are applying for an extension of time to file in excess of six months, check here .....

Original Return Due Date

For an additional extension, you must attach a statement explaining in detail why it is impossible or impractical to file

Extension Date Requested

by the due date. Enter the original due date and extension date requested.

PART 3 – Payment to Accompany Extension Request

Amount of payment accompanying extension request .....................................................................................................

$

Make check payable to the Washington State Department of Revenue. Please write the decedent’s name, social

security number, and date of death on the check to assist us in posting it to the proper account.

Payment of the Washington State Estate and Transfer Tax is due nine months after the date of death. If payment is not received, interest

accrues at the rate established by the Revised Code of Washington (RCW) 83.100.070 on any unpaid tax. Note: An extension of time does

not grant relief from the accrual of interest. Current interest rates can be found on the Department’s web site at:

Due Dates

The due date for the Washington State Estate and Transfer Tax Return is due nine months after the date of the decedent’s death. If there is

not a matching date in the ninth month, the due date is the last day of the ninth month. If the due date falls on a Saturday, Sunday, or a legal

holiday, the return is due on the next business day.

Who May File

The person required to file or an authorized attorney, certified public accountant, enrolled agent, or agent holding power of attorney may use

this form to apply for an extension of time to file. The form must be signed by the person filing the application. If filed by an attorney, certified

public accountant, enrolled agent, or agent holding a power of attorney, fill out the appropriate title next to the signature line.

Where to file

Mail Address:

Department of Revenue

Private Carrier:

Department of Revenue Estate Tax

Special Programs Division

Attn: Treasury Management

PO Box 47488

6500 Linderson Way SW Ste 227

Olympia, WA 98504-7488

Tumwater, WA 98501-6561

Signature and Verification

Under penalty of perjury, I declare that to the best of my knowledge and belief, the statements made herein and attached are true and correct

and I am authorized to file this application.

Filer’s Signature

Title

Date

For estate tax assistance call (360) 534-1503, option 2. To inquire about the availability of this document in an alternate format call 1-800-647-7706. Teletype

(TTY) users may use the Washington Relay Service by calling 711.

REV 85 0048 (10/25/16)

Print This Form (all copies)

1

1