Form Art-2-X Instructions - Amended Multiple Site Form

ADVERTISEMENT

General Information

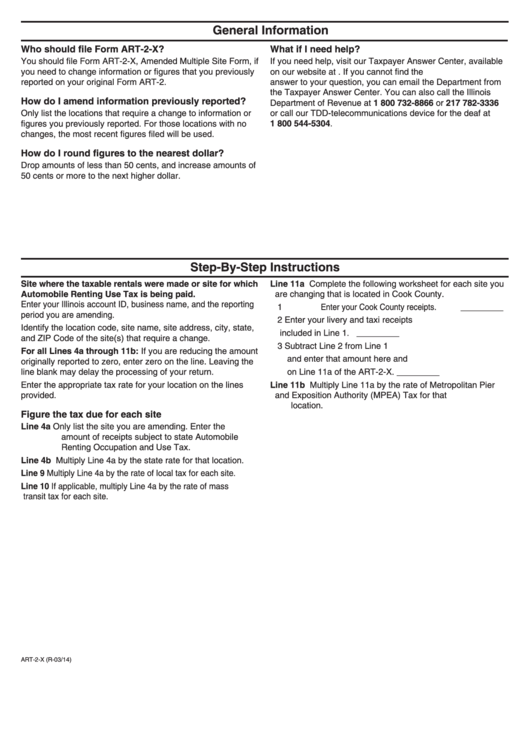

Who should file Form ART-2-X?

What if I need help?

You should file Form ART-2-X, Amended Multiple Site Form, if

If you need help, visit our Taxpayer Answer Center, available

on our website at tax.illinois.gov. If you cannot find the

you need to change information or figures that you previously

reported on your original Form ART-2.

answer to your question, you can email the Department from

the Taxpayer Answer Center. You can also call the Illinois

How do I amend information previously reported?

Department of Revenue at 1 800 732-8866 or 217 782-3336

or call our TDD-telecommunications device for the deaf at

Only list the locations that require a change to information or

figures you previously reported. For those locations with no

1 800 544-5304.

changes, the most recent figures filed will be used.

How do I round figures to the nearest dollar?

Drop amounts of less than 50 cents, and increase amounts of

50 cents or more to the next higher dollar.

Step-By-Step Instructions

Site where the taxable rentals were made or site for which

Line 11a Complete the following worksheet for each site you

Automobile Renting Use Tax is being paid.

are changing that is located in Cook County.

Enter your Illinois account ID, business name, and the reporting

1 Enter your Cook County receipts.

_________

period you are amending.

2 Enter your livery and taxi receipts

Identify the location code, site name, site address, city, state,

included in Line 1.

_________

and ZIP Code of the site(s) that require a change.

3 Subtract Line 2 from Line 1

For all Lines 4a through 11b: If you are reducing the amount

and enter that amount here and

originally reported to zero, enter zero on the line. Leaving the

line blank may delay the processing of your return.

on Line 11a of the ART-2-X.

_________

Enter the appropriate tax rate for your location on the lines

Line 11b Multiply Line 11a by the rate of Metropolitan Pier

provided.

and Exposition Authority (MPEA) Tax for that

location.

Figure the tax due for each site

Line 4a

Only list the site you are amending. Enter the

amount of receipts subject to state Automobile

Renting Occupation and Use Tax.

Line 4b

Multiply Line 4a by the state rate for that location.

Line 9

Multiply Line 4a by the rate of local tax for each site.

Line 10

If applicable, multiply Line 4a by the rate of mass

transit tax for each site.

ART-2-X (R-03/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1