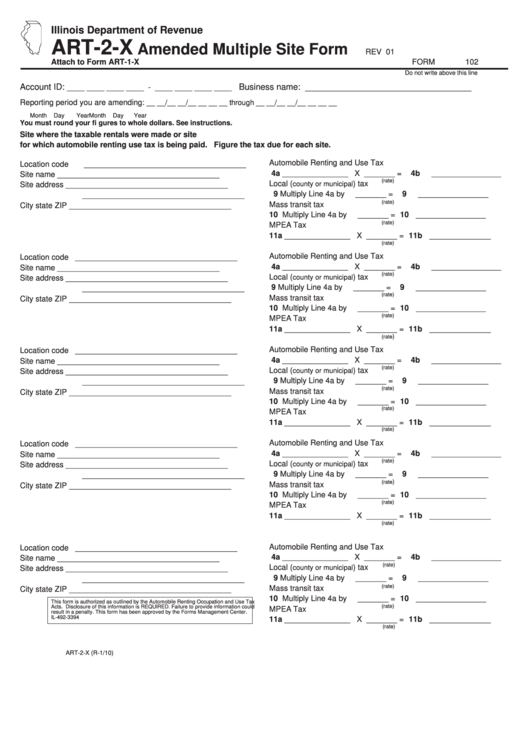

Illinois Department of Revenue

ART-2-X

Amended Multiple Site Form

REV

01

Attach to Form ART-1-X

FORM 102

Do not write above this line

Account ID:

Business name: ___________________________________

____ ____ ____ ____ - ____ ____ ____ ____

Reporting period you are amending:

__ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month

Day

Year

Month

Day

Year

You must round your fi gures to whole dollars. See instructions.

Site where the taxable rentals were made or site

for which automobile renting use tax is being paid.

Figure the tax due for each site.

Automobile Renting and Use Tax

Location code

_____________________________________

4a _______________

X _______ =

4b ________________

Site name

_____________________________________

(rate)

Local (

) tax

county or municipal

Site address

_____________________________________

9 Multiply Line 4a by

_______ =

9

________________

_____________________________________

(rate)

Mass transit tax

City state ZIP

_____________________________________

10 Multiply Line 4a by

_______ = 10

________________

(rate)

MPEA Tax

11a _______________

X _______ = 11b ______________

(rate)

Automobile Renting and Use Tax

Location code

_____________________________________

4a _______________

X _______ =

4b ________________

Site name

_____________________________________

(rate)

Local (

) tax

county or municipal

Site address

_____________________________________

9 Multiply Line 4a by

_______ =

9

________________

_____________________________________

(rate)

Mass transit tax

City state ZIP

_____________________________________

10 Multiply Line 4a by

_______ = 10

________________

(rate)

MPEA Tax

11a _______________

X _______ = 11b ______________

)

(rate

Automobile Renting and Use Tax

Location code

_____________________________________

4a _______________

X _______ =

4b ________________

Site name

_____________________________________

(rate)

Local (

) tax

county or municipal

Site address

_____________________________________

9 Multiply Line 4a by

_______ =

9

________________

_____________________________________

(rate)

Mass transit tax

City state ZIP

_____________________________________

10 Multiply Line 4a by

_______ = 10

________________

(rate)

MPEA Tax

11a _______________

X _______ = 11b ______________

(rate)

Automobile Renting and Use Tax

Location code

_____________________________________

4a _______________

X _______ =

4b ________________

Site name

_____________________________________

(rate)

Local (

) tax

county or municipal

Site address

_____________________________________

9 Multiply Line 4a by

_______ =

9

________________

_____________________________________

)

(rate

Mass transit tax

City state ZIP

_____________________________________

10 Multiply Line 4a by

_______ = 10

________________

(rate)

MPEA Tax

11a _______________

X _______ = 11b ______________

(rate)

Automobile Renting and Use Tax

Location code

_____________________________________

4a _______________

X _______ =

4b ________________

Site name

_____________________________________

(rate)

Local (

) tax

county or municipal

Site address

_____________________________________

9 Multiply Line 4a by

_______ =

9

________________

_____________________________________

(rate)

Mass transit tax

City state ZIP

_____________________________________

10 Multiply Line 4a by

_______ = 10

________________

This form is authorized as outlined by the Automobile Renting Occupation and Use Tax

(rate)

Acts. Disclosure of this information is REQUIRED. Failure to provide information could

MPEA Tax

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3394

11a _______________

X _______ = 11b ______________

(rate)

ART-2-X (R-1/10)

1

1