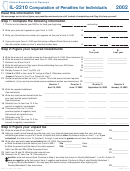

Step 3: Figure your unpaid tax

14

14

Write the amount from Column A, Line 3.

15

15

Write the amount of use tax from IL-1040, Line 22.

16

16

Add Lines 14 and 15. Write the total amount here.

17

Add your credit carried forward from the prior year (credited on or before April 18, 2011), your total estimated

payments made on or before April 18, 2011, your withholding as shown on your W-2 forms, and the pass-through

entity payments made on your behalf. Compare that total to either the amount written on Line 7, or, if you

17

annualized, the total of Line 9, Quarters 1 through 4, and write the greater amount here.

18

Write other payments made on or before April 18, 2011.

a

18a

Write the amount and the date of your Form IL-505-I.

Date:

__ __/__ __/__ __ __ __

b

18b

Write the amount and the date of any other payment.

Date:

__ __/__ __/__ __ __ __

18

Add Lines 18a and 18b. Write the amount here.

19

19

Add Lines 17 and 18. Write the total amount here.

20

Subtract Line 19 from Line 16. If the amount is

positive, write that amount here. Continue to Step 4, and write this amount in Penalty Worksheet 1, Line 22, Column C.

zero or negative, write that amount here, if negative use brackets. Continue to Step 4, skip Penalty Worksheet 1,

and go to Penalty Worksheet 2. You may apply this amount to any underpayment when fi guring your

20

Penalty Worksheet 2. See instructions.

Step 4: Figure your late-payment penalty

Use Penalty Worksheet 1 to fi gure your late-payment penalty for unpaid tax.

Use Penalty Worksheet 2 to fi gure your late-payment penalty for underpayment of estimated tax.

You must follow the instructions in order to properly complete the penalty worksheets.

Number of days late

Penalty rate

Penalty rates

1 - 30 ........................... .02

31 or more ..................... .10

Penalty Worksheet 1 –

Late-payment penalty for unpaid tax

21

Write the amount and the date of any payment you made on or after April 19, 2011. See instructions.

Amount

Date paid

Amount

Date paid

a

c

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

b

d

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

22

Write the amount from Line 20 on the fi rst line of Column C below.

A

B

C

D

E

F

G

H

I

Due

Unpaid

Payment

Balance due

Payment

Number of

Penalty rate

Period

date

amount

applied

(Col. C - Col. D)

date

days late

(See above)

Penalty

Return April 18, 2011

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

23

Add Column I. This is your late-payment penalty for unpaid tax.

23

Write the total amount here and on Line 34.

You may apply any remaining overpayment in Column E above to any underpayment when fi guring the Penalty Worksheet 2.

*061702110*

Page 2 of 4

IL-2210 (R-12/10)

1

1 2

2 3

3 4

4