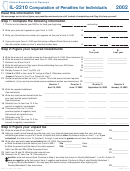

Step 6: Complete the annualization worksheet for Step 2, Line 9

Complete this worksheet only if your income was not received evenly throughout the year and you choose to annualize your

income. Complete Lines 38 through 54 of one column before going to the next, beginning with Column A.

A

B

C

D

January 1, 2010

January 1, 2010

January 1, 2010

January 1, 2010

to March 31, 2010

to May 31, 2010

to August 31, 2010

to December 31, 2010

38

Write your Illinois base income

38

for each period. See instructions.

4

2.4

1.5

1

39

39

Annualization factors.

40

Multiply Line 38 by Line 39.

40

This is your annualized income.

41

41

Exemptions. See instructions.

42

Subtract Line 41 from Line 40.

42

This is your Illinois net income.

43

43

Multiply Line 42 by 3% (.03).

44

For each period, write the

amount you wrote on

44

Step 2, Line 2, Column A.

45

45

Subtract Line 44 from Line 43.

22.5% (.225)

45% (.450)

67.5% (.675)

90% (.900)

46

46

Applicable percentage.

47

Multiply Line 45 by Line 46.

This is your annualized

47

installment.

48

Add the amounts on Line 54 of

each of the preceding columns

48

and write the total here.

Skip this line for Column A.

49

Subtract Line 48 from Line 47.

49

If less than zero, write “0.”

50

Write the amount from

50

Step 2, Line 8 in each column.

51

Write the amount from Line 53

51

Skip this line for Column A.

of the preceding column.

52

52

Add Lines 50 and 51.

53

If Line 52 is greater than

Line 49, subtract Line 49 from

53

Skip this line for Column D.

Line 52. Otherwise, write “0.”

54

Write the lesser of Line 49 or

Line 52 here and on Line 9.

This is your required

54

installment.

Reset

Print

*061704110*

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0031

Page 4 of 4

IL-2210 (R-12/10)

1

1 2

2 3

3 4

4