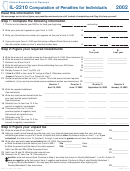

Penalty Worksheet 2 –

Late-payment penalty for underpayment of estimated tax

If you paid the required amount from Line 13 by the payment due date for each quarter, do not complete this worksheet.

24

Write the amount and the date of each estimated income tax payment you made. See instructions.

Estimated Income Tax Payments

Amount

Date paid

Amount

Date paid

Amount

Date paid

a

c

e

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

b

d

f

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

25

Write the unpaid amounts from Line 13, Quarters 1 through 4, on the fi rst line of the appropriate quarters in Column C below.

A

B

C

D

E

F

G

H

I

Due

Unpaid

Payment

Balance due

Payment

Number of

Penalty rate

Period

date

amount

applied

(Col. C - Col. D)

date

days late

(See above)

Penalty

Qtr 1 April 15, 2010

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

Qtr 2 June 15, 2010

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

Qtr 3 Sept. 15, 2010

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

Qtr 4 Jan. 18, 2011

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

26

Add Column I, Quarters 1 through 4. This is your late-payment penalty for underpayment of estimated tax.

26

Write the total amount here and on your Form IL-1040, Line 31 (round to whole dollars).

Step 5: Figure your late-fi ling penalty and the amount you owe

Figure your late-fi ling penalty only if

you are fi ling your tax return after October 15, 2011, and

your tax was not paid on or before April 18, 2011.

Figure your late-fi ling penalty.

27

27

Write the amount from Form IL-1040, Line 16.

28

28

Write the amount of use tax from Form IL-1040, Line 22.

29

29

Add Lines 27 and 28. Write the total amount here.

30

30

Write the total amount of credits and payments made on or before April 18, 2011.

31

31

Subtract Line 30 from Line 29.

32

32

Multiply the amount on Line 31 by 2% (.02).

33

33

Write the lesser of Line 32 or $250. This is your late-fi ling penalty.

Figure the amount you owe.

34

34

Write any late-payment penalty for unpaid tax from Line 23.

35

35

Write any late-fi ling penalty from Line 33.

36

If you have an overpayment on Form IL-1040, Line 34, write that amount as a <negative number>.

36

If you have an amount due on Form IL-1040, Line 38, write that amount as a positive number.

37

Add Lines 34 through 36. If the result is a negative number, this is the amount you are overpaid (before any amount

applied to next year’s estimated tax). If the result is a positive number, this is the amount you owe. See Form IL-1040

37

instructions for your payment options.

*061703110*

IL-2210 (R-12/10)

Page 3 of 4

1

1 2

2 3

3 4

4