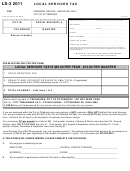

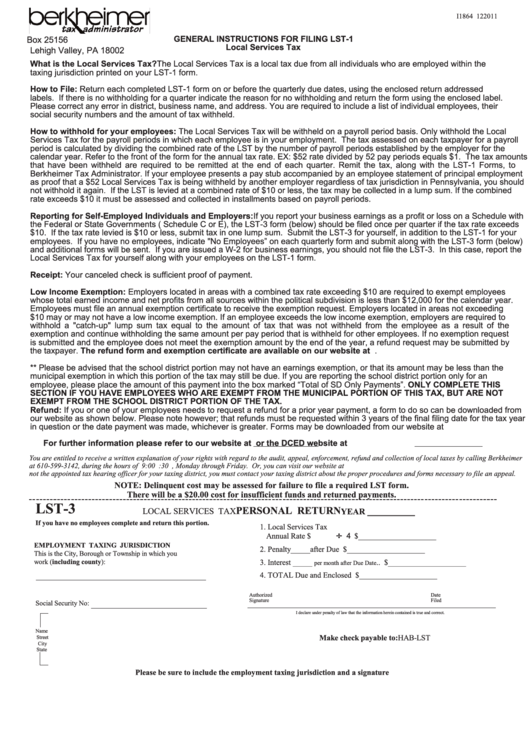

Form Lst-3 - Local Services Tax Personal Return - 2011

ADVERTISEMENT

I1864 122011

GENERAL INSTRUCTIONS FOR FILING LST-1

P.O. Box 25156

Local Services Tax

Lehigh Valley, PA 18002

What is the Local Services Tax? The Local Services Tax is a local tax due from all individuals who are employed within the

taxing jurisdiction printed on your LST-1 form.

How to File: Return each completed LST-1 form on or before the quarterly due dates, using the enclosed return addressed

labels. If there is no withholding for a quarter indicate the reason for no withholding and return the form using the enclosed label.

Please correct any error in district, business name, and address. You are required to include a list of individual employees, their

social security numbers and the amount of tax withheld.

How to withhold for your employees: The Local Services Tax will be withheld on a payroll period basis. Only withhold the Local

Services Tax for the payroll periods in which each employee is in your employment. The tax assessed on each taxpayer for a payroll

period is calculated by dividing the combined rate of the LST by the number of payroll periods established by the employer for the

calendar year. Refer to the front of the form for the annual tax rate. EX: $52 rate divided by 52 pay periods equals $1. The tax amounts

that have been withheld are required to be remitted at the end of each quarter. Remit the tax, along with the LST-1 Forms, to

Berkheimer Tax Administrator. If your employee presents a pay stub accompanied by an employee statement of principal employment

as proof that a $52 Local Services Tax is being withheld by another employer regardless of tax jurisdiction in Pennsylvania, you should

not withhold it again. If the LST is levied at a combined rate of $10 or less, the tax may be collected in a lump sum. If the combined

rate exceeds $10 it must be assessed and collected in installments based on payroll periods.

Reporting for Self-Employed Individuals and Employers: If you report your business earnings as a profit or loss on a Schedule with

the Federal or State Governments (e.g. Schedule C or E), the LST-3 form (below) should be filed once per quarter if the tax rate exceeds

$10. If the tax rate levied is $10 or less, submit tax in one lump sum. Submit the LST-3 for yourself, in addition to the LST-1 for your

employees. If you have no employees, indicate "No Employees” on each quarterly form and submit along with the LST-3 form (below)

and additional forms will be sent. If you are issued a W-2 for business earnings, you should not file the LST-3. In this case, report the

Local Services Tax for yourself along with your employees on the LST-1 form.

Receipt: Your canceled check is sufficient proof of payment.

Low Income Exemption: Employers located in areas with a combined tax rate exceeding $10 are required to exempt employees

whose total earned income and net profits from all sources within the political subdivision is less than $12,000 for the calendar year.

Employees must file an annual exemption certificate to receive the exemption request. Employers located in areas not exceeding

$10 may or may not have a low income exemption. If an employee exceeds the low income exemption, employers are required to

withhold a "catch-up" lump sum tax equal to the amount of tax that was not withheld from the employee as a result of the

exemption and continue withholding the same amount per pay period that is withheld for other employees. If no exemption request

is submitted and the employee does not meet the exemption amount by the end of the year, a refund request may be submitted by

the taxpayer. The refund form and exemption certificate are available on our website at

** Please be advised that the school district portion may not have an earnings exemption, or that its amount may be less than the

municipal exemption in which this portion of the tax may still be due. If you are reporting the school district portion only for an

employee, please place the amount of this payment into the box marked “Total of SD Only Payments”. ONLY COMPLETE THIS

SECTION IF YOU HAVE EMPLOYEES WHO ARE EXEMPT FROM THE MUNICIPAL PORTION OF THIS TAX, BUT ARE NOT

EXEMPT FROM THE SCHOOL DISTRICT PORTION OF THE TAX.

Refund: If you or one of your employees needs to request a refund for a prior year payment, a form to do so can be downloaded from

our website as shown below. Please note however; that refunds must be requested within 3 years of the final filing date for the tax year

in question or the date payment was made, whichever is greater. Forms may be downloaded from our website at

For further information please refer to our website at or the DCED website at

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by calling Berkheimer

at 610-599-3142, during the hours of 9:00 a.m. through 4:30 p.m., Monday through Friday. Or, you can visit our website at If Berkheimer is

not the appointed tax hearing officer for your taxing district, you must contact your taxing district about the proper procedures and forms necessary to file an appeal.

NOTE: Delinquent cost may be assessed for failure to file a required LST form.

There will be a $20.00 cost for insufficient funds and returned payments.

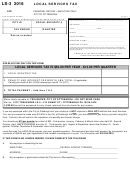

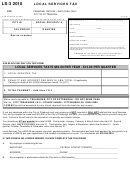

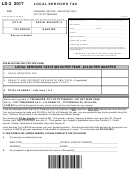

LST-3

PERSONAL RETURN

LOCAL SERVICES TAX

YEAR __________

If you have no employees complete and return this portion.

1. Local Services Tax

Annual Rate $

4 .............. $ ____________________

EMPLOYMENT TAXING JURISDICTION

2. Penalty_____after Due Date.............. $ ____________________

This is the City, Borough or Township in which you

work (including county):

3. Interest _____

.. $ ____________________

per month after Due Date

4. TOTAL Due and Enclosed ................ $ ____________________

Authorized

Date

Signature

Filed

Social Security No:

I declare under penalty of law that the information herein contained is true and correct.

Name

Make check payable to:

HAB-LST

Street

City

State

Please be sure to include the employment taxing jurisdiction and a signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1