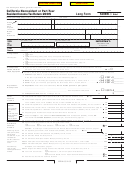

Form 540nr C1 Draft - California Nonresident Or Part-Year Resident Income Tax Return 2006 Page 2

ADVERTISEMENT

Your name: ______________________________________Your SSN or ITIN: ______________________________

38 Amount from Side 1, line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

39 Alternative minimum tax. Attach Schedule P (540NR). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

39

40 Mental Health Services Tax (see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

41 Other taxes and credit recapture (see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

41

42 Add line 38 through line 41. This is your total tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42

43 California income tax withheld (see page 20). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

43

44 Nonresident withholding (Form(s) 592-B, 593-B, or 594) (see page 20). . . . . . . . . . . . . . . . . .

44

45

(see page 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

45

2006 CA estimated tax and other payments

46 Excess SDI. To see if you qualify (see page 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

46

Child and Dependent Care Expenses Credit (see page 21). Attach form FTB 3506.

-

-

-

-

47 _________

______

_________

48 _________

______

_________

49 __________________

50

51 Add line 43, line 44, line 45, line 46, and line 50. These are your total payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

52 Overpaid tax. If line 51 is more than line 42, subtract line 42 from line 51 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

53 Amount of line 52 you want applied to your 2007 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

53

54 Overpaid tax available this year. Subtract line 53 from line 52 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

54

55 Tax due. If line 51 is less than line 42, subtract line 51 from line 42 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

00

00

CA Seniors Special Fund (see page 36) . . . . . . . . . . . . . . . . . . .

56

Emergency Food Assistance Program Fund . . . . . .

63

00

00

Alzheimer’s Disease/Related Disorders Fund . . . . . . . . . . . . . . .

57

CA Peace Officer Memorial Foundation Fund . . . . .

64

00

00

CA Fund for Senior Citizens . . . . . . . . . . . . . . . . . . . . . . . . . . . .

58

CA Military Family Relief Fund . . . . . . . . . . . . . . . .

65

00

00

Rare and Endangered Species Preservation Program . . . . . . . . .

59

Veterans’ Quality of Life Fund . . . . . . . . . . . . . . . . .

66

00

00

State Children’s Trust Fund for the Prevention of Child Abuse . .

60

CA Sexual Violence Victim Services Fund . . . . . . . .

67

00

00

CA Breast Cancer Research Fund . . . . . . . . . . . . . . . . . . . . . . . .

61

CA Colorectal Cancer Prevention Fund . . . . . . . . . .

68

00

00

CA Firefighters’ Memorial Fund. . . . . . . . . . . . . . . . . . . . . . . . . .

62

CA Sea Otter Fund . . . . . . . . . . . . . . . . . . . . . . . . .

69

00

70 Add line 56 through line 69. These are your total contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

70

71 AMOUNT YOU OWE. Add line 55, and line 70 (see page 21). Do not send cash.

.

,

,

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001 . . . . . . . . . . . 71

72 Interest, late return penalties, and late payment penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

73 Underpayment of estimated tax. Fill in the circle:

FTB 5805 attached

FTB 5805F attached . . . . . . . . . . . . . . . . . . 73

74 Total amount due (see page 23). Enclose, but do not staple, any payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

75 REFUND OR NO AMOUNT DUE. Subtract line 70 from line 54.

.

,

,

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0002 . . . . . . . . . . . . 75

Fill in the information to have your refund directly deposited to one or two separate accounts. Do not attach a voided check or a deposit slip (see page 23).

All or portion of total refund (line 75) you want to direct deposit:

Checking

.

,

,

Savings

Routing number

Type

Account number

76 Amount you want to direct deposit

Remaining portion of total refund (line 75) you want to direct deposit:

Checking

.

,

,

Savings

Routing number

Type

Account number

77 Amount you want to direct deposit

Sign

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal return. Under penalties of perjury, I declare that I have

examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Here

Your signature

Spouse’s signature (if a joint return, both must sign)

Daytime phone number (optional)

)

(

I

t is unlawful to

forge a spouse’s

X

X

Date

signature.

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Paid preparer’s SSN/PTIN

Joint return?

(see page 23)

Firm’s name (or yours if self-employed)

Firm’s address

FEIN

Side 2 Long Form 540NR

2006

3132063

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2