Form Mo-A - Information To Complete Form Mo-A - Mo Department Of Revenue Page 5

ADVERTISEMENT

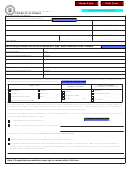

W

L

-T

C

I

D

ORKSHEET FOR

ONG

ERM

ARE

NSURANCE

EDUCTION

.

A

Enter the amount paid for qualified long-term care insurance policy. ..... A) $______________

If you itemized on your federal return and your federal itemized deductions

included medical expenses, go to Line B. If not, you are eligible for the full

amount paid as shown on Line A.

B.

Enter the amount from Federal Schedule A, Line 4. ................................ B) $______________

C.

Enter the amount from Federal Schedule A, Line 1. ................................ C) $______________

D.

Enter the amount of qualified long-term care included on Line C. ..........D) $______________

E.

Subtract Line D from Line C. .................................................................. E) $______________

0

F.

Subtract Line E from Line B. If amount is less than zero, enter “0”. ...... F) $______________

0

G.

Subtract Line F from Line A. ................................................................... G) $______________

0

Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A (if you itemized your deductions).

Back to MO-1040, page 1

QUALIFIED HEALTH INSURANCE PREMIUMS WORKSHEET FOR MO-A, LINE 11

Complete this worksheet if you included health insurance premiums paid as an itemized deduction or had health insurance premiums withheld from your social

security benefits.

If you had premiums withheld from your social security benefits, complete Lines 1 through 4 to determine your taxable percentage of social security income and

the corresponding taxable portion of your health insurance premiums included in your taxable income.

1. Enter amount from Line 14a (federal Form 1040A) or 20a (federal Form 1040). If $0, skip to Line 6 and enter

your total health insurance premiums paid.

1. ___________

2. Enter amount from Line 14b (federal Form 1040A) or 20b (federal Form 1040).

2. ___________

0

3. Divide Line 2 by Line 1

3. ___________ %

Yourself

Spouse

4. Enter the health insurance premiums withheld from your social security income.

4Y. ___________

4S. ___________

0

0

5. Multiply the amounts on Line 4Y and 4S by the percentage on Line 3.

5Y. ___________

5S. ___________

6. Enter the total of all other health insurance premiums paid, which were not included in 4Y or 4S.

6Y. ___________

6S. ___________

7. Add the amounts from Lines 5 and 6. If you itemized on your federal return and your federal

itemized deductions included health insurance premiums as medical expenses, go on to Line

0

0

8. If not, enter amounts from 7Y and 7S on Line 11 of Form MO-A.

7Y. ___________

7S. ___________

0

8. Add the amounts from 7Y and 7S.

8. ___________

0

0

9. Divide Line 7Y and 7S by the total found on Line 8.

9Y. ___________

9S. ___________

10. Enter the amount from Federal Schedule A, Line 1.

10. ___________

11. Enter the amount from Schedule A, Line 4.

11. ___________

0

12. Divide Line 11 by Line 10 (round to full percent).

12. ___________

0

13. Multiply Line 8 by percent on Line 12.

13. ___________

0

14. Subtract Line 13 from Line 8.

14. ___________

15 . Multiply Line 14 by the percentages found on Lines 9Y and 9S. Enter the amounts on Line 15Y

0

0

and 15S of this worksheet on Line 11 of Form MO-A.

15Y. ___________

15S. ___________

Back to MOA, Line 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5