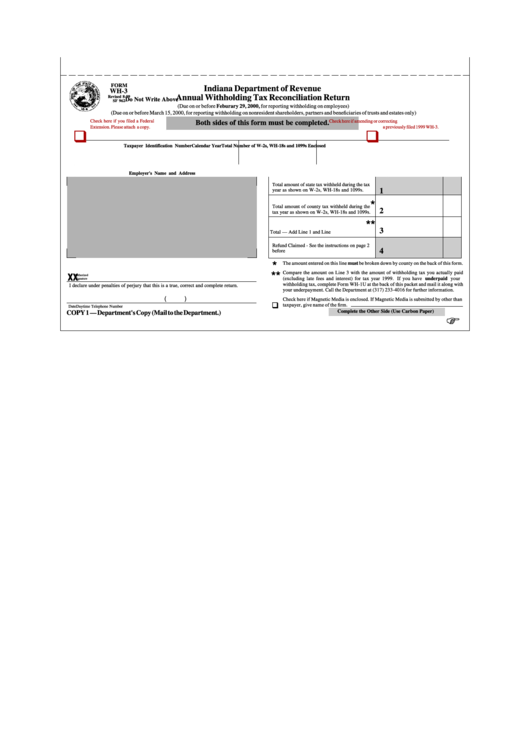

Form Wh-3 - Annual Withholding Tax Reconciliation Return

ADVERTISEMENT

FORM

Indiana Department of Revenue

WH-3

Annual Withholding Tax Reconciliation Return

Revised 8-99

Do Not Write Above

SF 962

(Due on or before Feburary 29, 2000, for reporting withholding on employees)

(Due on or before March 15, 2000, for reporting withholding on nonresident shareholders, partners and beneficiaries of trusts and estates only)

Check here if you filed a Federal

Check here if amending or correcting

Both sides of this form must be completed.

Extension. Please attach a copy.

a previously filed 1999 WH-3.

Taxpayer Identification Number

Calendar Year

Total Number of W-2s, WH-18s and 1099s Enclosed

Employer's Name and Address

otal amount of state tax withheld during the tax

T

1

year as shown on W-2s, WH-18s and 1099s.

*

Total amount of county tax withheld during the

2

tax year as shown on W-2s, WH-18s and 1099s.

**

3

Total — Add Line 1 and Line 2...........................

Refund Claimed - See the instructions on page 2

4

before completing................................................

*

The amount entered on this line must be broken down by county on the back of this form.

Compare the amount on Line 3 with the amount of withholding tax you actually paid

**

X X X X X

Authorized

(excluding late fees and interest) for tax year 1999. If you have underpaid your

Signature

withholding tax, complete Form WH-1U at the back of this packet and mail it along with

I declare under penalties of perjury that this is a true, correct and complete return.

your underpayment. Call the Department at (317) 233-4016 for further information.

(

)

Check here if Magnetic Media is enclosed. If Magnetic Media is submitted by other than

taxpayer, give name of the firm.

Date

Daytime Telephone Number

Complete the Other Side (Use Carbon Paper)

COPY 1 — Department's Copy (Mail to the Department.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2