Form Mw508 - Annual Employer Withholding Reconciliation Report - 2002

ADVERTISEMENT

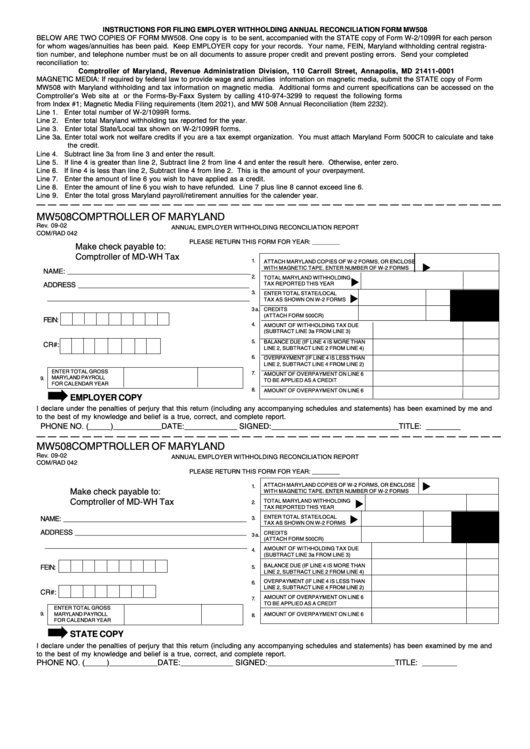

INSTRUCTIONS FOR FILING EMPLOYER WITHHOLDING ANNUAL RECONCILIATION FORM MW508

BELOW ARE TWO COPIES OF FORM MW508. One copy is to be sent, accompanied with the STATE copy of Form W-2/1099R for each person

for whom wages/annuities has been paid. Keep EMPLOYER copy for your records. Your name, FEIN, Maryland withholding central registra-

tion number, and telephone number must be on all documents to assure proper credit and prevent posting errors. Send your completed

reconciliation to:

Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001

MAGNETIC MEDIA: If required by federal law to provide wage and annuities information on magnetic media, submit the STATE copy of Form

MW508 with Maryland withholding and tax information on magnetic media. Additional forms and current specifications can be accessed on the

Comptroller’s Web site at or the Forms-By-Faxx System by calling 410-974-3299 to request the following forms

from Index #1; Magnetic Media Filing requirements (Item 2021), and MW 508 Annual Reconciliation (Item 2232).

Line 1. Enter total number of W-2/1099R forms.

Line 2. Enter total Maryland withholding tax reported for the year.

Line 3. Enter total State/Local tax shown on W-2/1099R forms.

Line 3a. Enter total work not welfare credits if you are a tax exempt organization. You must attach Maryland Form 500CR to calculate and take

the credit.

Line 4. Subtract line 3a from line 3 and enter the result.

Line 5. If line 4 is greater than line 2, Subtract line 2 from line 4 and enter the result here. Otherwise, enter zero.

Line 6. If line 4 is less than line 2, Subtract line 4 from line 2. This is the amount of your overpayment.

Line 7. Enter the amount of line 6 you wish to have applied as a credit.

Line 8. Enter the amount of line 6 you wish to have refunded. Line 7 plus line 8 cannot exceed line 6.

Line 9. Enter the total gross Maryland payroll/retirement annuities for the calender year.

MW508

COMPTROLLER OF MARYLAND

Rev. 09-02

ANNUAL EMPLOYER WITHHOLDING RECONCILIATION REPORT

COM/RAD 042

PLEASE RETURN THIS FORM FOR YEAR: ________

Make check payable to:

Comptroller of MD-WH Tax

1.

ATTACH MARYLAND COPIES OF W-2 FORMS, OR ENCLOSE

WITH MAGNETIC TAPE. ENTER NUMBER OF W-2 FORMS

NAME: _______________________________________________

2.

TOTAL MARYLAND WITHHOLDING

TAX REPORTED THIS YEAR

ADDRESS ____________________________________________

3.

ENTER TOTAL STATE/LOCAL

____________________________________________________

TAX AS SHOWN ON W-2 FORMS

3 a.

CREDITS

(ATTACH FORM 500CR)

FEIN:

4.

AMOUNT OF WITHHOLDING TAX DUE

(SUBTRACT LINE 3a FROM LINE 3)

5.

BALANCE DUE (IF LINE 4 IS MORE THAN

CR#:

LINE 2, SUBTRACT LINE 2 FROM LINE 4)

6.

OVERPAYMENT (IF LINE 4 IS LESS THAN

LINE 2, SUBTRACT LINE 4 FROM LINE 2)

ENTER TOTAL GROSS

7.

AMOUNT OF OVERPAYMENT ON LINE 6

MARYLAND PAYROLL

9.

TO BE APPLIED AS A CREDIT

FOR CALENDAR YEAR

8.

AMOUNT OF OVERPAYMENT ON LINE 6

EMPLOYER COPY

I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and

to the best of my knowledge and belief is a true, correct, and complete report.

PHONE NO. ( _____ ) ___________ DATE: ____________ SIGNED: _____________________________ TITLE: ________

MW508

COMPTROLLER OF MARYLAND

Rev. 09-02

ANNUAL EMPLOYER WITHHOLDING RECONCILIATION REPORT

COM/RAD 042

PLEASE RETURN THIS FORM FOR YEAR: ________

ATTACH MARYLAND COPIES OF W-2 FORMS, OR ENCLOSE

1.

Make check payable to:

WITH MAGNETIC TAPE. ENTER NUMBER OF W-2 FORMS

Comptroller of MD-WH Tax

TOTAL MARYLAND WITHHOLDING

2.

TAX REPORTED THIS YEAR

ENTER TOTAL STATE/LOCAL

NAME: _______________________________________________

3.

TAX AS SHOWN ON W-2 FORMS

ADDRESS ____________________________________________

CREDITS

3 a.

(ATTACH FORM 500CR)

____________________________________________________

AMOUNT OF WITHHOLDING TAX DUE

4.

(SUBTRACT LINE 3a FROM LINE 3)

BALANCE DUE (IF LINE 4 IS MORE THAN

FEIN:

5.

LINE 2, SUBTRACT LINE 2 FROM LINE 4)

OVERPAYMENT (IF LINE 4 IS LESS THAN

6.

LINE 2, SUBTRACT LINE 4 FROM LINE 2)

CR#:

AMOUNT OF OVERPAYMENT ON LINE 6

7.

TO BE APPLIED AS A CREDIT

ENTER TOTAL GROSS

9.

MARYLAND PAYROLL

AMOUNT OF OVERPAYMENT ON LINE 6

8.

FOR CALENDAR YEAR

STATE COPY

I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and

to the best of my knowledge and belief is a true, correct, and complete report.

PHONE NO. ( _____ ) ___________ DATE: ____________ SIGNED: _____________________________ TITLE: ________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1