Page 2

How do I apply?

2. All documentation related to merchandising, endorsements,

sponsorship income, production or tour support, and

You must submit a written application and appropriate

reimbursement in any way associated with this activity or

attachments.

event.

The only standard portion of an application for a CWA is the

3. An itinerary of dates and locations of all performances or

application form itself appearing at the end of these instructions.

events to be covered by the CWA. Include any anticipated

The remainder of the application will consist of a computer-

performances that may be in negotiation or planning. Tours

generated letter from you explaining the facts requested below,

crossing calendar years may require additional information

along with the appropriate attachments.

and will require a separate CWA for each year.

Each individual requesting a CWA must submit a timely

4. A spreadsheet containing the proposed budget showing

application. This includes all members of the group, regardless

itemized estimates of all gross income (including but not

as to whether or not they share in the profit of the tour or event.

limited to income attributable to items listed in 1 and 2

This also includes any back-up singer or musician who is

above) and US expenses for the tour or event. If the tour

requesting a CWA. When requesting a CWA for multiple

encompasses events outside of the US, separately state the

individuals list each individual and provide the complete

US income and expenses.

information for each.

5. A list of any previous CWA(s) for the calendar year in which

You may need to provide additional information that affects the

the CWA is requested. If there is any US source income

computation or completion of the CWA that is requested by the

previously earned in the calendar year not claimed on a

IRS. This information must be provided by the deadline

CWA, provide the income, the source and verification of

provided by the IRS when requested. Delays in response may

amounts withheld and deposited. If no prior income, state

jeopardize the approval of the CWA.

not applicable.

Each CWA application must include the following

6. For each NRA, state whether the NRA has been in the US

statement and must either be signed by the NRA or by an

providing personal services during the current or six prior

authorized representative of the NRA

years. Provide the US taxpayer SSN or ITIN of the NRA for

“I wish to obtain a Central Withholding Agreement between the

whom the income and deductions were reported.

nonresident alien athlete/entertainer, the withholding agent, and

the Internal Revenue Service covering the services to be

For an Athlete, attach the following:

provided as shown.

Under penalties of perjury, I declare that I have examined this

1. Copies of all agreements presented to the athletic

application, including any accompanying schedules, exhibits,

association (e.g. bout agreements).

affidavits, and statements and to the best of my knowledge and

2. Copies of any other agreements regarding residual income,

belief it is true, correct, and complete."

such as Pay Per View or exclusive television rights to

athlete's home country.

Initial Application must include:

3. Copies of documents related to any other income such as

1. Name of NRA(s) to be covered by CWA

endorsement income or sponsorship contracts.

2. SSN or ITIN of NRA if known

4. Date and location of this event as well as the promoter

3. Tour dates or event to be covered

name.

4. POA for NRA as appropriate

5. State whether the NRA has been in the US providing

5. Preliminary Budget

personal services during the current or six prior years.

Provide the US taxpayer SSN or ITIN of the NRA for whom

Supporting Documents Required to

the income and deductions were reported.

6. A spreadsheet of all expenses for the event such as

Evaluate Your Application

manager, trainer, cut man, sanction fee, sparring partner,

training facility expense, and travel to and from home

1. Complete all boxes on the application form at the end of

country. List all persons in the travel party and their function.

these instructions with information regarding the NRA, the

7. List any previous CWA(s) for the calendar year in which the

withholding agent and an alternate contact representative, if

CWA is requested. If there is any US source income

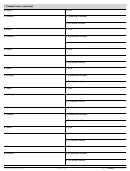

desired. For CWAs involving multiple entertainers, complete

previously earned in the calendar year not claimed on a

the continuation sheet.

CWA, list the income, the source and verification of

amounts withheld and deposited. If no prior income, state

For an Entertainer(s), attach the following:

'not applicable'.

1. Copies of all documentation related to income of the

NOTE: These lists are not all inclusive. If other information

covered NRA(s) regarding the time period and

supports positions taken on the budget, include it.

performances or events to be covered by the CWA.

Documentation should include (but not be limited to)

contracts, letters of understanding, offer letters,

engagement letters, agreements with employers, agents,

representatives, promoters, venues such as exhibition halls

and the like.

13930

Catalog Number 50991Q

Form

(Rev. 8-2016)

1

1 2

2 3

3 4

4 5

5 6

6