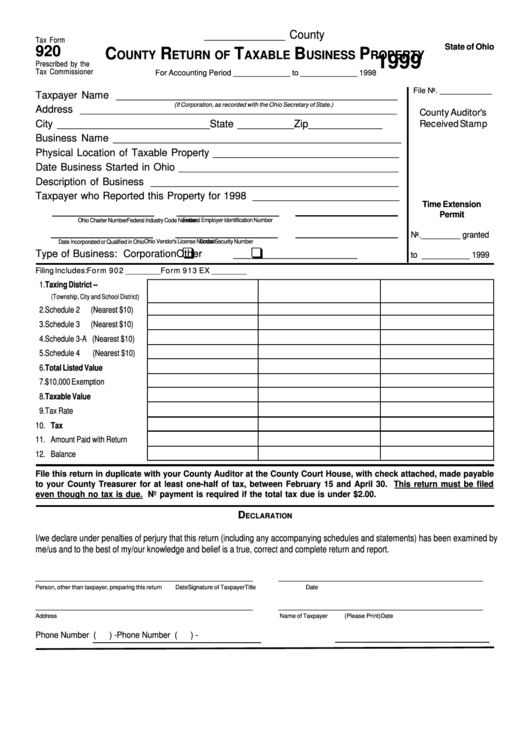

_____________ County

Tax Form

State of Ohio

920

C

R

T

B

P

OUNTY

ETURN OF

AXABLE

USINESS

ROPERTY

1999

Prescribed by the

Tax Commissioner

For Accounting Period _____________ to _____________ 1998

File No. ____________

Taxpayer Name __________________________________________________

(If Corporation, as recorded with the Ohio Secretary of State.)

Address ________________________________________________________

County Auditor's

Received Stamp

City ___________________________ State __________ Zip_____________

Business Name ___________________________________________________

Physical Location of Taxable Property _________________________________

Date Business Started in Ohio _______________________________________

Description of Business ____________________________________________

Taxpayer who Reported this Property for 1998 __________________________

Time Extension

Permit

Federal Employer Identification Number

Ohio Charter Number

Federal Industry Code Number

No._________ granted

Social Security Number

Ohio Vendor's License Number

Date Incorporated or Qualified in Ohio

q

q

Type of Business: Corporation

Other

______________________

to ___________ 1999

Filing Includes:

Form 902 _________

Form 913 EX _________

1. Taxing District --

(Township, City and School District)

2. Schedule 2

(Nearest $10)

3. Schedule 3

(Nearest $10)

4. Schedule 3-A (Nearest $10)

5. Schedule 4

(Nearest $10)

6. Total Listed Value

7. $10,000 Exemption

8. Taxable Value

9. Tax Rate

10. Tax

11. Amount Paid with Return

12. Balance

File this return in duplicate with your County Auditor at the County Court House, with check attached, made payable

to your County Treasurer for at least one-half of tax, between February 15 and April 30. This return must be filed

even though no tax is due. No payment is required if the total tax due is under $2.00.

D

ECLARATION

I/we declare under penalties of perjury that this return (including any accompanying schedules and statements) has been examined by

me/us and to the best of my/our knowledge and belief is a true, correct and complete return and report.

__________________________________________________

_______________________________________________

Person, other than taxpayer, preparing this return

Date

Signature of Taxpayer

Title

Date

__________________________________________________

_______________________________________________

Address

Name of Taxpayer

(Please Print)

Date

Phone Number (

) -

Phone Number (

) -

1

1 2

2