Vt Form Br-400 (Formerly Form S-1) - Application For Business Tax Account Page 3

ADVERTISEMENT

*154001300*

From Form BR-400, Part 1, Lines 2-4

* 1 5 4 0 0 1 3 0 0 *

Business Name __________________________________________

FEIN ___________________

Sole Proprietor Name _____________________________________

SSN ___________________

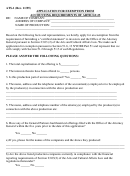

PART 4 - COMPLIANCE CHECK -

All applicants must complete this section.

1. Has the Vermont Department of Taxes required a bond for this business entity or any business

Yes*

No

entity in which any person listed in Part 1 was an officer or held a 20% or more interest?

2. Has the Vermont Department of Taxes suspended or revoked a Sales and Use or Meals and

Rooms Tax license for this business entity or any business entity in which any person listed in

Yes*

No

Part 1 was an officer or held a 20% or more interest?

3. Have you previously had a principal interest in a business with a Vermont Business Tax account?

Yes*

No

*If any answer in Part 3 is “Yes”, please attach explanation.

PART 5 - CERTIFICATION -

All applicants must complete this section.

I certify under pains and penalty of perjury this application is true, correct and complete to the best of my knowledge.

Signature _________________________________________________

Title ___________________________________

Name ____________________________________________________

Date ___________________________________

(Please print)

Additional Information / Comments

Please allow two weeks for processing. If you need expedited processing, please contact us.

Send or fax completed application to:

Questions? Contact us by:

Vermont Department of Taxes

PO Box 547

Telephone: (802) 828-2551, option #3

Montpelier, VT 05601-0547

Email:

tax.business@vermont.gov

Fax: (802) 828-5787

Form BR-400 (formerly Form S-1)

Page 3 of 3

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5