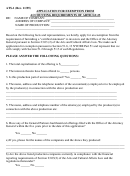

Vt Form Br-400 (Formerly Form S-1) - Application For Business Tax Account Page 5

ADVERTISEMENT

Vermont Department of Taxes PO Box 547

Montpelier, VT 05601-0547

*1540B1200*

Phone: (802) 828-2551

VT Schedule

Account Application

BR-400B

* 1 5 4 0 B 1 2 0 0 *

Attach to Form BR-400

From Form BR-400, Part 1, Lines 2-4

Business Name ___________________________________________________________________ FEIN _______________________________

Sole Proprietor Name ______________________________________________________________ SSN _______________________________

* If filing for more than one tax type or location, file multiple copies of this form. *

Tax Type - Check ONE

Meals and Rooms (MR)

Sales and Use (SU)

Withholding (WH)

(complete Lines 1-3 and 7-10d)

(complete Lines 1-3 and 7-10d)

(complete Lines 4-10d)

1. Start Date (or Expected Start Date)

2. Estimate of quarterly TAX liability

3. Business Operation

(Lines 1-3 for MR or SU only)

$499 or less

Year Round

Occasional

$500 or more

Seasonal Months of Operation:

____ / ____ / ________

from _______ to _______

mm

dd

yyyy

mm

mm

4. Start Date (or Expected Start Date)

5. Estimate of quarterly TAX liability

6. Federal Withholding

(Lines 4-6 for WH only)

Depositing Requirement

$2,499 or less

Annual

Semi-weekly

____ / ____ / ________

$2,500 - $8,999

Quarterly

Not Yet

mm

dd

yyyy

$9,000 or more - Requires ACH Credit

Established

Monthly

7. Name of Payroll/Filing Service used

No filing

service

8. Your Business Physical Location (Do not enter PO Box)

Same as

Applicant

City

State

ZIP

9. Your Business Mailing Address

Same as

Applicant

City

State

ZIP

10a. Person to contact - Last Name

First Name

10b. Telephone Number

10c. Title

10d. Fax Number

10e. E-mail address

Schedule BR-400B

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5