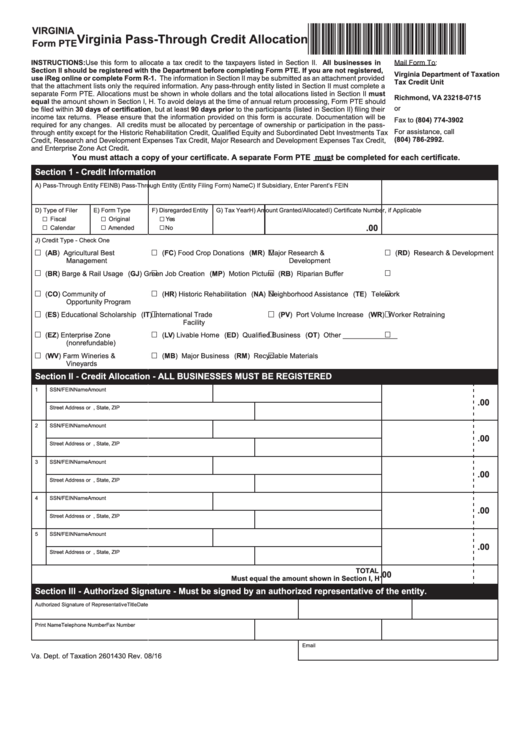

*VA0PTC116888*

VIRGINIA

Virginia Pass-Through Credit Allocation

Form PTE

INSTRUCTIONS: Use this form to allocate a tax credit to the taxpayers listed in Section II. All businesses in

Mail Form To:

Section II should be registered with the Department before completing Form PTE. If you are not registered,

Virginia Department of Taxation

use iReg online or complete Form R-1. The information in Section II may be submitted as an attachment provided

Tax Credit Unit

that the attachment lists only the required information. Any pass-through entity listed in Section II must complete a

P.O. Box 715

separate Form PTE. Allocations must be shown in whole dollars and the total allocations listed in Section II must

Richmond, VA 23218-0715

equal the amount shown in Section I, H. To avoid delays at the time of annual return processing, Form PTE should

or

be filed within 30 days of certification, but at least 90 days prior to the participants (listed in Section II) filing their

income tax returns. Please ensure that the information provided on this form is accurate. Documentation will be

Fax to (804) 774-3902

required for any changes. All credits must be allocated by percentage of ownership or participation in the pass-

For assistance, call

through entity except for the Historic Rehabilitation Credit, Qualified Equity and Subordinated Debt Investments Tax

(804) 786-2992.

Credit, Research and Development Expenses Tax Credit, Major Research and Development Expenses Tax Credit,

and Enterprise Zone Act Credit.

You must attach a copy of your certificate. A separate Form PTE must be completed for each certificate.

Section 1 - Credit Information

A) Pass-Through Entity FEIN

B) Pass-Through Entity (Entity Filing Form) Name

C) If Subsidiary, Enter Parent’s FEIN

D) Type of Filer

E) Form Type

F) Disregarded Entity

G) Tax Year

H) Amount Granted/Allocated

I) Certificate Number, if Applicable

Fiscal

Original

Yes

.00

Calendar

Amended

No

J) Credit Type - Check One

(AB) Agricultural Best

(FC) Food Crop Donations

(MR) Major Research &

(RD) Research & Development

Management

Development

(BR) Barge & Rail Usage

(GJ) Green Job Creation

(MP) Motion Picture

(RB) Riparian Buffer

(CO) Community of

(HR) Historic Rehabilitation

(NA) Neighborhood Assistance

(TE) Telework

Opportunity Program

(ES) Educational Scholarship

(IT)

International Trade

(PV) Port Volume Increase

(WR) Worker Retraining

Facility

(EZ) Enterprise Zone

(LV) Livable Home

(ED) Qualified Business

(OT) Other ______________

(nonrefundable)

(WV) Farm Wineries &

(MB) Major Business

(RM) Recyclable Materials

Vineyards

Section ll - Credit Allocation - ALL BUSINESSES MUST BE REGISTERED

1

SSN/FEIN

Name

Amount

.00

Street Address or P.O. Box

City, State, ZIP

2

SSN/FEIN

Name

Amount

.00

Street Address or P.O. Box

City, State, ZIP

3

SSN/FEIN

Name

Amount

.00

Street Address or P.O. Box

City, State, ZIP

4

SSN/FEIN

Name

Amount

.00

Street Address or P.O. Box

City, State, ZIP

5

SSN/FEIN

Name

Amount

.00

Street Address or P.O. Box

City, State, ZIP

TOTAL

.00

Must equal the amount shown in Section I, H

Section lll - Authorized Signature - Must be signed by an authorized representative of the entity.

Authorized Signature of Representative

Title

Date

Print Name

Telephone Number

Fax Number

Email

Va. Dept. of Taxation 2601430 Rev. 08/16

1

1