Form Pte - Virginia Pass-Through Credit Allocation - 2003

ADVERTISEMENT

VA0PTE103777

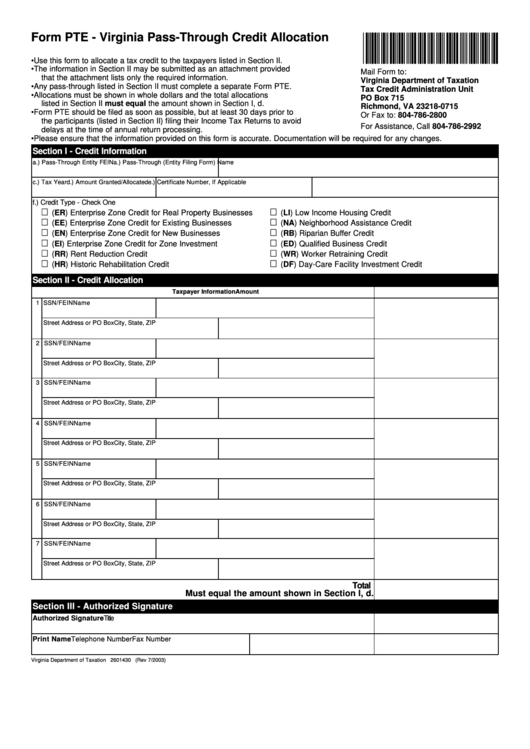

Form PTE - Virginia Pass-Through Credit Allocation

• Use this form to allocate a tax credit to the taxpayers listed in Section II.

• The information in Section II may be submitted as an attachment provided

Mail Form to:

that the attachment lists only the required information.

Virginia Department of Taxation

• Any pass-through listed in Section II must complete a separate Form PTE.

Tax Credit Administration Unit

• Allocations must be shown in whole dollars and the total allocations

PO Box 715

listed in Section II must equal the amount shown in Section I, d.

Richmond, VA 23218-0715

• Form PTE should be filed as soon as possible, but at least 30 days prior to

Or Fax to: 804-786-2800

the participants (listed in Section II) filing their Income Tax Returns to avoid

For Assistance, Call 804-786-2992

delays at the time of annual return processing.

• Please ensure that the information provided on this form is accurate. Documentation will be required for any changes.

Section I - Credit Information

a.) Pass-Through Entity FEIN

a.) Pass-Through (Entity Filing Form) Name

c.) Tax Year

d.) Amount Granted/Allocated

e.) Certificate Number, If Applicable

f.) Credit Type - Check One

(ER) Enterprise Zone Credit for Real Property Businesses

(LI) Low Income Housing Credit

(EE) Enterprise Zone Credit for Existing Businesses

(NA) Neighborhood Assistance Credit

(EN) Enterprise Zone Credit for New Businesses

(RB) Riparian Buffer Credit

(EI) Enterprise Zone Credit for Zone Investment

(ED) Qualified Business Credit

(RR) Rent Reduction Credit

(WR) Worker Retraining Credit

(HR) Historic Rehabilitation Credit

(DF) Day-Care Facility Investment Credit

Section II - Credit Allocation

Taxpayer Information

Amount

1 SSN/FEIN

Name

Street Address or PO Box

City, State, ZIP

2 SSN/FEIN

Name

Street Address or PO Box

City, State, ZIP

3 SSN/FEIN

Name

Street Address or PO Box

City, State, ZIP

4 SSN/FEIN

Name

Street Address or PO Box

City, State, ZIP

5 SSN/FEIN

Name

Street Address or PO Box

City, State, ZIP

6 SSN/FEIN

Name

Street Address or PO Box

City, State, ZIP

7 SSN/FEIN

Name

Street Address or PO Box

City, State, ZIP

Total

Must equal the amount shown in Section I, d.

Section III - Authorized Signature

Authorized Signature

Title

Print Name

Telephone Number

Fax Number

Virginia Department of Taxation 2601430 (Rev 7/2003)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1