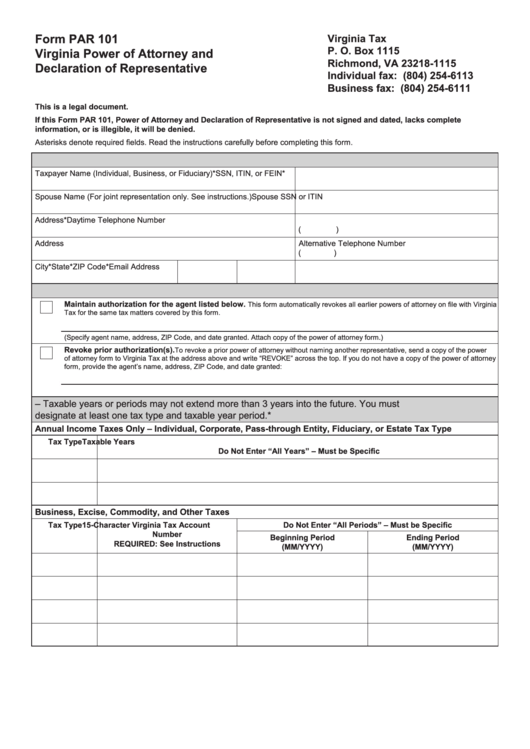

Form PAR 101

Virginia Tax

P. O. Box 1115

Virginia Power of Attorney and

Richmond, VA 23218-1115

Declaration of Representative

Individual fax: (804) 254-6113

Business fax: (804) 254-6111

This is a legal document.

If this Form PAR 101, Power of Attorney and Declaration of Representative is not signed and dated, lacks complete

information, or is illegible, it will be denied.

Asterisks denote required fields. Read the instructions carefully before completing this form.

1. Taxpayer Information

Taxpayer Name (Individual, Business, or Fiduciary)*

SSN, ITIN, or FEIN*

Spouse Name (For joint representation only. See instructions.)

Spouse SSN or ITIN

Address*

Daytime Telephone Number

(

)

Address

Alternative Telephone Number

(

)

City*

State*

ZIP Code*

Email Address

2. Maintain or Revoke Prior Authorization

Maintain authorization for the agent listed below.

This form automatically revokes all earlier powers of attorney on file with Virginia

Tax for the same tax matters covered by this form.

(Specify agent name, address, ZIP Code, and date granted. Attach copy of the power of attorney form.)

Revoke prior authorization(s).

To revoke a prior power of attorney without naming another representative, send a copy of the power

of attorney form to Virginia Tax at the address above and write “REVOKE” across the top. If you do not have a copy of the power of attorney

form, provide the agent’s name, address, ZIP Code, and date granted:

3. Tax Matters – Taxable years or periods may not extend more than 3 years into the future. You must

designate at least one tax type and taxable year period.*

Annual Income Taxes Only – Individual, Corporate, Pass-through Entity, Fiduciary, or Estate Tax Type

Tax Type

Taxable Years

Do Not Enter “All Years” – Must be Specific

Business, Excise, Commodity, and Other Taxes

Tax Type

15-Character Virginia Tax Account

Do Not Enter “All Periods” – Must be Specific

Number

Beginning Period

Ending Period

REQUIRED: See Instructions

(MM/YYYY)

(MM/YYYY)

1

1 2

2