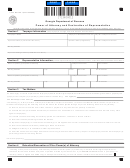

4. Authorized Agent /Representative Information. Additional representatives should be listed on an

attached list and may not receive copies of correspondence.

Automatic Correspondence

Primary Representative – Must be a person; cannot be a business

An Authorized Agent will automatically be mailed

First Name*

Last Name*

copies of correspondence regarding the tax

matters.

Address

Authorized Agent Number

A - _________________________

Address

Do NOT mail copies of any correspondence

to agent.

City

State

ZIP Code

Mail copies of email communications to

agent.

Daytime Telephone Number

Fax Number

Email Address

(

)

(

)

Additional Representative – Must be a person; cannot be a business

Automatic Correspondence

An Authorized Agent will automatically be mailed

First Name

Last Name

copies of correspondence regarding the tax

matters.

Address

Authorized Agent Number

A - _________________________

Address

Do NOT mail copies of any correspondence

to agent.

City

State

ZIP Code

Mail copies of email communications to

agent.

Daytime Telephone Number

Fax Number

Email Address

(

)

(

)

5. Signature of Taxpayer(s) and Acknowledgment of Authorized Acts

By signing this form, I am granting the representative(s) listed in Section 4 the authority to:

•

Receive and inspect my confidential tax information for the tax matters listed in Section 3,

•

Perform all acts that I can perform with respect to the specified tax matters, and

•

Represent me before Virginia Tax, including consenting to extend the time to assess tax and executing consents that

agree to a tax adjustment.

•

In addition, I understand that the acts of my Authorized Agent may increase or decrease my tax liabilities and legal rights.

The authority does not, however, include the power to receive refund checks, substitute another representative, request a

copy of a tax return, sign certain returns, or consent to a disclosure of tax information.

For joint representation, both the taxpayer and the spouse listed in Section 1 must sign and date this form. If this form is

signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of

the taxpayer, they certify that they have the authority to execute this form on behalf of the taxpayer. This power of attorney will

remain in effect until it is revoked by either the taxpayer or the agent.

Print Name*

Signature*

Title

Date*

Print Name

Signature

Title

Date

6. Representative Signature:

Under penalties of perjury, I declare I am authorized to represent the taxpayer(s)

listed in Section 1.

A.) Attorney

B.) Certified Public Accountant

C.) Enrolled Agent

D.) Family member or Other (provide relationship below):

____________________________________________________________________________________

Relationship:

Designation

Representative

Letter from

Print Name *

Representative Signature*

Date*

Above List

Primary

Additional

1

1 2

2