Form Ct-1120k - Business Tax Credit Summary - 2007 Page 3

ADVERTISEMENT

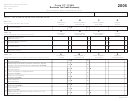

Part I-E

A

B

C

D

E

Electronic Data Processing

Carryforward Amount From

Credit Amount

Amount Applied to

Amount Applied to

Carryforward

Equipment Property Tax Credit

Previous Income Years

Claimed

Corporation Tax

Other Taxes

Amount to 2008

32 Electronic Data Processing Equipment

00

00

00

00

00

Property - Form CT-1120 EDPC

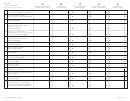

Part II - Tax Credits Applied to the Corporation Business Tax

Combined return filers – Do not complete Part II.

1 Tax Credit Limitation: Enter amount from Form CT-1120, Schedule C, Line 4.

00

00

2 Financial Institutions Credit: Enter amount from Form CT-1120K, Part I-A, Line 1, Column B. Do not exceed amount on Line 1.

00

3 Creditable corporation business tax balance: Subtract Line 2 from Line 1.

00

4 Tax Credits With Carryback Provisions: Enter amount from Form CT-1120K, Part I-B, Line 5, Column B. Do not exceed amount on Line 3.

5 Creditable corporation business tax balance: Subtract Line 4 from Line 3.

00

6 Tax Credits Without Carryback or Carryforward Provisions: Enter amount from Form CT-1120K, Part I-C, Line 15, Column B.

00

Do not exceed amount on Line 5.

00

7 Creditable corporation business tax balance: Subtract Line 6 from Line 5.

8 Tax Credits With Carryforward Provisions: Enter amount from Form CT-1120K, Part I-D, Line 31, Column C. Do not exceed amount on Line 7.

00

Carryforward credits that expire first should be claimed before any credit carryforward that will expire later or not at all.

00

9 Creditable corporation business tax balance: Subtract Line 8 from Line 7.

10 Electronic Data Processing Equipment Property Tax Credit: Enter amount from Form CT-1120K, Part I-E, Line 32, Column C. Carryforward

00

credits that expire first should be claimed before any credit carryforward that will expire later. Do not exceed amount on Line 9.

11 Total Corporation Business Tax Credits Applied: Add Part II, Lines 2, 4, 6, 8, and 10. Enter here and on Form CT-1120, Schedule C, Line 5.

00

Do not exceed amount on Line 1.

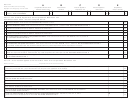

Part III - Tax Credits Applied to Taxes Other Than the Corporation Business Tax

Name of tax: __________________________ Duplicate Part III as necessary.

1 Tax: Enter the creditable tax amount from the appropriate tax form. The amount of tax credit(s) allowable against the insurance premiums and health care center

00

taxes may not exceed 70% (.70) of the amount of tax due prior to the application of the credit(s).

00

2 Tax Credits With Carryback Provisions: Enter amount from Form CT-1120K, Part I-B, Line 5, Column C. Do not exceed amount on Line 1.

00

3 Tax balance: Subtract Line 2 from Line 1.

4 Tax Credits Without Carryback or Carryforward Provisions: Enter amount from Form CT-1120K, Part I-C, Line 15, Column C.

00

Do not exceed the amount on Line 3.

00

5 Tax balance: Subtract Line 4 from Line 3.

00

6 Tax Credits With Carryforward Provisions: Enter amount from Form CT-1120K, Part I-D, Line 31, Column D. Do not exceed amount on Line 5.

00

7 Tax balance: Subtract Line 6 from Line 5.

8 Electronic Data Processing Equipment Property Tax Credit: (Enter amount from Form CT-1120K, Part I-E, Line 32, Column D.

Do not exceed amount on Line 7.

00

9 Total Tax Credits Applied to Taxes Other Than the Corporation Business Tax: Add Part III, Lines 2, 4, 6, and 8.

00

Enter here and on the appropriate tax return. Do not exceed amount on Line 1.

Page 3 of 3

Form CT-1120K (Rev. 12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3