Instructions For Filing Resident Wholesaler’s Monthly Report

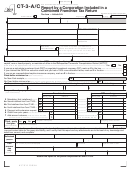

Line 1 – Enter actual beginning inventory of unstamped cigarettes in column (a). Multiply column (a)

by $0.02125. Enter results in column (b).

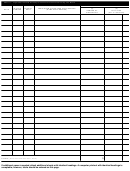

Line 2 – Enter all cigarettes purchased during the month in column (a) (see Part II). Multiply column

(a) by $0.02125. Enter results in column (b).

Line 3 – Add lines 1 and 2 for both columns (a) and (b).

Line 4 – Enter total cigarettes sold to National Guard Units in column (a) (see Part III). Multiply

column (a) by $0.02125. Enter results in column (b).

Line 5 – Enter total cigarettes sold to the U.S. Government in column (a) (see Part IV). Multiply

column (a) by $0.02125. Enter results in column (b).

Line 6 – Enter the grand total of cigarettes sold in other states in column (a) (see Schedule C). Multiply

results by $0.02125. Enter results in column (b).

Line 7 – Enter in column (a) cigarettes returned to the manufacturer bearing another state’s stamp.

(NOTE: Do not include cigarettes to be returned to the manufacturer bearing an Alabama

stamp.) Multiply column (a) by $0.02125. Enter the results in column (b).

Line 8 – Enter actual ending inventory of Alabama unstamped cigarettes at end of month in column

(a). Multiply column (a) by $0.02125. Enter results in column (b).

Line 9 – Add lines 4 through 8. Indicate total cigarettes in column (a). Multiply column (a) by

$0.02125. Enter results in column (b).

Line 10 – Subtract line 3 from line 9 for both columns (a) and (b). Schedule D must be completed to

show Alabama taxed cigarettes and/or roll-your-own tobacco produced by a manufacturer

not participating in the tobacco Master Settlement Agreement.

Line 11 – Indicate purchases of stamps from the Alabama Department of Revenue by showing invoice

date, invoice number and stamp value.

Line 12 – Enter value of cigarette stamps purchased during the month.

Line 13 – Enter the value of cigarette stamps on hand at beginning of month.

Line 14 – Enter the results of adding lines 12 and 13.

Line 15 – Enter the actual value of cigarette stamps on hand at end of month.

Line 16 – Enter the results of subtracting line 15 from line 14.

Line 17 – Enter the results of subtracting line 10 (b) from line 16.

1

1 2

2 3

3 4

4