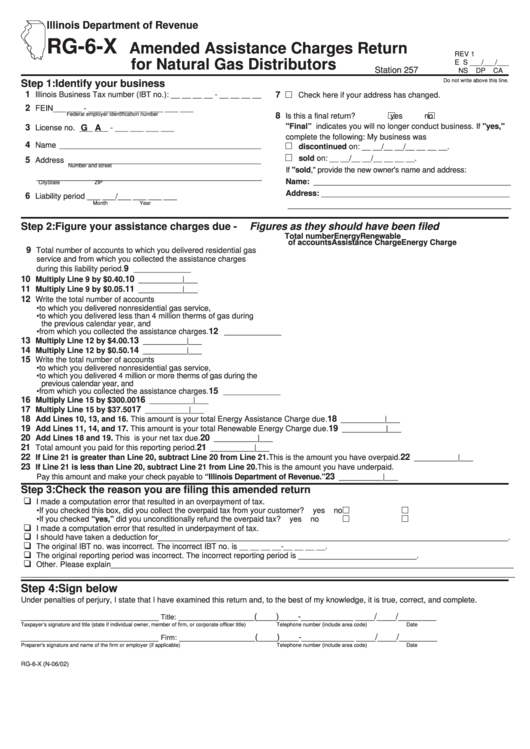

Form Rg-6-X - Amended Assistance Charges Return For Natural Gas Distributors - 2002

ADVERTISEMENT

Illinois Department of Revenue

RG-6-X

Amended Assistance Charges Return

REV 1

for Natural Gas Distributors

E S ___/___/___

Station 257

NS

DP

CA

Do not write above this line.

Step 1: Identify your business

1

Illinois Business Tax number (IBT no.): __ __ __ __ - __ __ __ __

7

Check here if your address has changed.

2

FEIN

___ ___ - ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

8

Is this a final return?

yes

no

"Final” indicates you will no longer conduct business. If "yes,"

3

G A

License no. ___ ___ - ___ ___ ___ ___

complete the following: My business was

4

Name ______________________________________________

discontinued on: __ __/__ __/__ __ __ __.

sold on: __ __/__ __/__ __ __ __.

5

Address ____________________________________________

Number and street

If "sold," provide the new owner's name and address:

___________________________________________________

Name: _____________________________________________

City

State

ZIP

Address: ___________________________________________

6

Liability period ___ ___/___ ___ ___ ___

Month

Year

___________________________________________________

Step 2: Figure your assistance charges due - Figures as they should have been filed

Total number

Energy

Renewable

of accounts

Assistance Charge

Energy Charge

9

Total number of accounts to which you delivered residential gas

service and from which you collected the assistance charges

9

during this liability period.

_____________

10

10

Multiply Line 9 by $0.40.

__________|___

11

11

Multiply Line 9 by $0.05.

__________|___

12

Write the total number of accounts

• to which you delivered nonresidential gas service,

• to which you delivered less than 4 million therms of gas during

the previous calendar year, and

12

• from which you collected the assistance charges.

_____________

13

13

Multiply Line 12 by $4.00.

__________|___

14

14

Multiply Line 12 by $0.50.

__________|___

15

Write the total number of accounts

• to which you delivered nonresidential gas service,

• to which you delivered 4 million or more therms of gas during the

previous calendar year, and

15

• from which you collected the assistance charges.

_____________

16

16

Multiply Line 15 by $300.00

__________|___

17

17

Multiply Line 15 by $37.50

__________|___

18

18

Add Lines 10, 13, and 16. This amount is your total Energy Assistance Charge due.

__________|___

19

19

Add Lines 11, 14, and 17. This amount is your total Renewable Energy Charge due.

__________|___

20

20

Add Lines 18 and 19. This is your net tax due.

__________|___

21

21

Total amount you paid for this reporting period.

__________|___

22

22

If Line 21 is greater than Line 20, subtract Line 20 from Line 21.This is the amount you have overpaid.

__________|___

23

If Line 21 is less than Line 20, subtract Line 21 from Line 20.This is the amount you have underpaid.

23

Pay this amount and make your check payable to “Illinois Department of Revenue.”

__________|___

Step 3:

Check the reason you are filing this amended return

I made a computation error that resulted in an overpayment of tax.

• If you checked this box, did you collect the overpaid tax from your customer?

yes

no

• If you checked “yes,” did you unconditionally refund the overpaid tax?

yes

no

I made a computation error that resulted in underpayment of tax.

I should have taken a deduction for________________________________________________________________________________.

The original IBT no. was incorrect. The incorrect IBT no. is __ __ __ __-__ __ __ __.

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

Other. Please explain ____________________________________________________________________________________________

_________________________________________________________________________________________________________________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________

________________

(____)____-___________

____/____/________

Title:

Taxpayer’s signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

_____________________________

________________

(____)____-___________

____/____/________

Firm:

Preparer's signature and name of the firm or employer (if applicable)

Telephone number (include area code)

Date

RG-6-X (N-06/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2