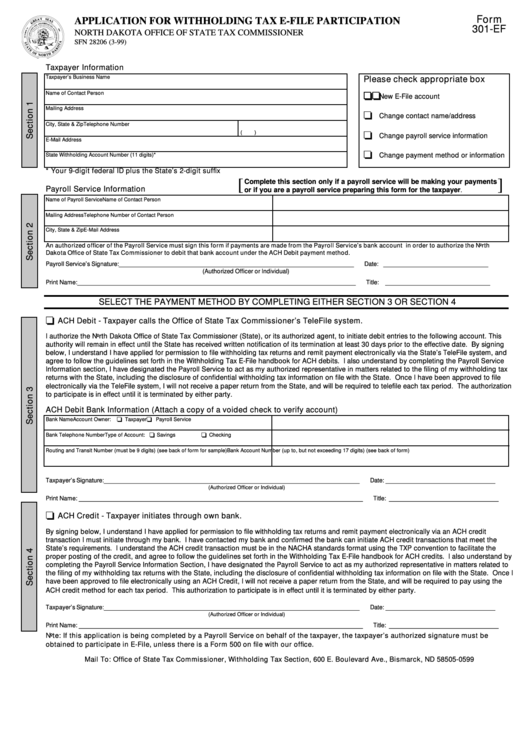

Form

APPLICATION FOR WITHHOLDING TAX E-FILE PARTICIPATION

301-EF

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 28206 (3-99)

Taxpayer Information

Taxpayer’s Business Name

Please check appropriate box

❏ ❏ ❏ ❏ ❏

Name of Contact Person

New E-File account

Mailing Address

❏

Change contact name/address

City, State & Zip

Telephone Number

❏

(

)

Change payroll service information

E-Mail Address

❏

State Withholding Account Number (11 digits)*

Change payment method or information

* Your 9-digit federal ID plus the State’s 2-digit suffix

[

]

Complete this section only if a payroll service will be making your payments

Payroll Service Information

or if you are a payroll service preparing this form for the taxpayer.

Name of Payroll Service

Name of Contact Person

Mailing Address

Telephone Number of Contact Person

City, State & Zip

E-Mail Address

An authorized officer of the Payroll Service must sign this form if payments are made from the Payroll Service’s bank account in order to authorize the North

Dakota Office of State Tax Commissioner to debit that bank account under the ACH Debit payment method.

_________________________________________________________________

_____________________________

Payroll Service’s Signature:

Date:

(Authorized Officer or Individual)

_____________________________________________________________________________

_____________________________

Print Name:

Title:

SELECT THE PAYMENT METHOD BY COMPLETING EITHER SECTION 3 OR SECTION 4

❏

ACH Debit - Taxpayer calls the Office of State Tax Commissioner’s TeleFile system.

I authorize the North Dakota Office of State Tax Commissioner (State), or its authorized agent, to initiate debit entries to the following account. This

authority will remain in effect until the State has received written notification of its termination at least 30 days prior to the effective date. By signing

below, I understand I have applied for permission to file withholding tax returns and remit payment electronically via the State’s TeleFile system, and

agree to follow the guidelines set forth in the Withholding Tax E-File handbook for ACH debits. I also understand by completing the Payroll Service

Information section, I have designated the Payroll Service to act as my authorized representative in matters related to the filing of my withholding tax

returns with the State, including the disclosure of confidential withholding tax information on file with the State. Once I have been approved to file

electronically via the TeleFile system, I will not receive a paper return from the State, and will be required to telefile each tax period. The authorization

to participate is in effect until it is terminated by either party.

ACH Debit Bank Information (Attach a copy of a voided check to verify account)

❏ Taxpayer

❏ Payroll Service

Bank Name

Account Owner:

Type of Account: ❏ Savings

❏ Checking

Bank Telephone Number

Routing and Transit Number (must be 9 digits) (see back of form for sample)

Bank Account Number (up to, but not exceeding 17 digits) (see back of form)

_______________________________________________________________

___________________________

Taxpayer’s Signature:

Date:

(Authorized Officer or Individual)

______________________________________________________________________

___________________________

Print Name:

Title:

❏

ACH Credit - Taxpayer initiates through own bank.

By signing below, I understand I have applied for permission to file withholding tax returns and remit payment electronically via an ACH credit

transaction I must initiate through my bank. I have contacted my bank and confirmed the bank can initiate ACH credit transactions that meet the

State’s requirements. I understand the ACH credit transaction must be in the NACHA standards format using the TXP convention to facilitate the

proper posting of the credit, and agree to follow the guidelines set forth in the Withholding Tax E-File handbook for ACH credits. I also understand by

completing the Payroll Service Information Section, I have designated the Payroll Service to act as my authorized representative in matters related to

the filing of my withholding tax returns with the State, including the disclosure of confidential withholding tax information on file with the State. Once I

have been approved to file electronically using an ACH Credit, I will not receive a paper return from the State, and will be required to pay using the

ACH credit method for each tax period. This authorization to participate is in effect until it is terminated by either party.

_______________________________________________________________

___________________________

Taxpayer’s Signature:

Date:

(Authorized Officer or Individual)

______________________________________________________________________

___________________________

Print Name:

Title:

Note: If this application is being completed by a Payroll Service on behalf of the taxpayer, the taxpayer’s authorized signature must be

obtained to participate in E-File, unless there is a Form 500 on file with our office.

Mail To: Office of State Tax Commissioner, Withholding Tax Section, 600 E. Boulevard Ave., Bismarck, ND 58505-0599

1

1