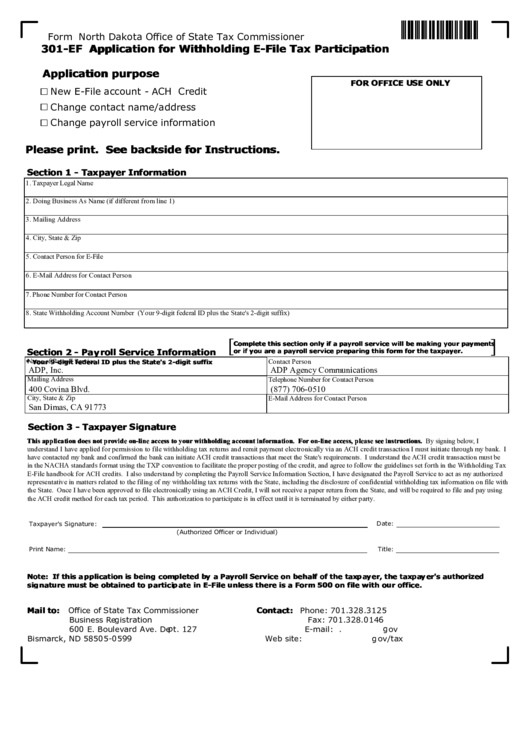

Form

North Dakota Office of State Tax Commissioner

301-EF

Application for Withholding E-File Tax Participation

Application purpose

FOR OFFICE USE ONLY

New E-File account - ACH Credit

Change contact name/address

Change payroll service information

Please print. See backside for Instructions.

Section 1 - Taxpayer Information

1. Taxpayer Legal Name

2. Doing Business As Name (if different from line 1)

3. Mailing Address

4. City, State & Zip

5. Contact Person for E-File

6. E-Mail Address for Contact Person

7. Phone Number for Contact Person

8. State Withholding Account Number (Your 9-digit federal ID plus the State's 2-digit suffix)

[

]

Complete this section only if a payroll service will be making your payments

Section 2 - Payroll Service Information

or if you are a payroll service preparing this form for the taxpayer.

* Your 9-digit federal ID plus the State's 2-digit suffix

Name of Payroll Service

Contact Person

ADP, Inc.

ADP Agency Communications

Mailing Address

Telephone Number for Contact Person

400 Covina Blvd.

(877) 706-0510

City, State & Zip

E-Mail Address for Contact Person

San Dimas, CA 91773

Section 3 - Taxpayer Signature

This application does not provide on-line access to your withholding account information. For on-line access, please see instructions. By signing below, I

understand I have applied for permission to file withholding tax returns and remit payment electronically via an ACH credit transaction I must initiate through my bank. I

have contacted my bank and confirmed the bank can initiate ACH credit transactions that meet the State's requirements. I understand the ACH credit transaction must be

in the NACHA standards format using the TXP convention to facilitate the proper posting of the credit, and agree to follow the guidelines set forth in the Withholding Tax

E-File handbook for ACH credits. I also understand by completing the Payroll Service Information Section, I have designated the Payroll Service to act as my authorized

representative in matters related to the filing of my withholding tax returns with the State, including the disclosure of confidential withholding tax information on file with

the State. Once I have been approved to file electronically using an ACH Credit, I will not receive a paper return from the State, and will be required to file and pay using

the ACH credit method for each tax period. This authorization to participate is in effect until it is terminated by either party.

Date:

Taxpayer's Signature:

(Authorized Officer or Individual)

Print Name:

Title:

Note: If this application is being completed by a Payroll Service on behalf of the taxpayer, the taxpayer's authorized

signature must be obtained to participate in E-File unless there is a Form 500 on file with our office.

Mail to: Office of State Tax Commissioner

Contact: Phone: 701.328.3125

Business Registration

Fax: 701.328.0146

600 E. Boulevard Ave. Dept. 127

E-mail: withhold@nd.gov

Bismarck, ND 58505-0599

Web site:

1

1 2

2