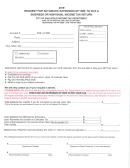

SIDNEY - 2015 INDIVIDUAL INCOME TAX RETURN

Due on or before April 18, 2016 –

LATE FILING OF THIS RETURN MAY RESULT IN INTEREST CHARGES AND

A MINIMUM $25.00 PENALTY

Signature of preparer, if other than taxpayer

Phone Number

Date

PAGE ONE OF THE FEDERAL FORM 1040 MUST BE ATTACHED TO ALL

RETURNS.

ALL APPROPRIATE FEDERAL

SCHEDULES MUST BE ATTACHED. A RETURN IS NOT COMPLETE UNLESS SUCH SCHEDULES ARE ATTACHED. ANY DEDUCTION

NOT PROPERLY SUPPORTED WILL BE DISALLOWED.

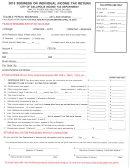

WORKSHEET A: EMPLOYEE BUSINESS EXPENSES -- FORM 2106 WORKSHEET (page 1 of Federal Form 1040, Federal Schedule A,

and Federal Form 2106 must be attached for deduction to be allowed.)

Unreimbursed employee expenses from Form 2106……………..…$ _____________

1.

2. Total from Line 24 on Form 1040, Schedule A………………….…...$ _____________

3. Percent of total…………………………………………………………… _____________% (Divide line 1by line 2)

0.00%

4. Enter amount from line 27 on Schedule A of Form 1040……….…..$ _____________

5. Sidney income tax deduction ………………………………………….$ _____________

(Multiply line 3 by line 4)

(Enter deduction on Page 1, line 2 of this return)

WORKSHEET B – OTHER INCOME (As documented by Returns, Attachments, 1099’s and Schedules)

Net Taxable Gain

If applicable, Allocation Pct

Sidney Taxable Gain

(Loss)

from Sch Y below

(Loss)

1. Proprietorship (Schedule C) – Enter business name(s)

below.

0.00%

2. Rental Income (Schedule E) – Enter street address

and city of each property below. (Losses without street

address and city will be disallowed).

3. Recapture of Depreciation on Sale of Rental Property

(Schedule 4797)

4. Reportable Partnership Income (Schedule E / K-1)

5. Farm Income (Schedule F)

6. Other Income not derived from compensation

8. SUBTOTAL (Add lines 1 – 7 above)

9. LESS: LOSS CARRYFORWARD , IF ANY, FROM PRIOR YEARS (ATTACH SCHEDULE)

10. GRAND TOTAL (Line 8 minus Line 9) **

** If the GRAND TOTAL on line 10 is a net gain (positive), enter the amount on page 1, line 4.

If the GRAND TOTAL on line 10 is a net loss (negative), enter $0 on page 1, line 4, and include this net loss on your

schedule of Net Operating Losses which may be carried forward for up to 5 years

.

** In no case may business losses be taken against wages or other compensation. Only the resident partner’s share of partnership or S-

Corp income or losses not attributable to Sidney should be included on this return.

SCHEDULE Y – BUSINESS ALLOCATION FORMULA

The Business Allocation Formula is to be used by non-resident taxpayers who are doing business both inside and outside of Sidney to determine the portion of the

net profits attributed to Sidney. In lieu of using Schedule Y, businesses located wholly within the Sidney city limits must include copies of tax returns filed and paid in

other cities in order to receive credit for taxes paid to other cities.

A. LOCATED

B. LOCATED IN

C. PERCENTAGE

EVERYWHERE

SIDNEY

(B/A)

Step 1

Average original cost of real & tangible personal property

$

$

Gross annual rentals multiplied by 8

$

$

0.00%

Total Step 1

$

$

%

Total qualifying wages, salaries, commissions and other

0.00%

Step 2

compensation for all employees

$

$

%

0.00%

Step 3

Gross receipts from sales and work or services

$

$

%

0.00%

Step 4

TOTAL PERCENTAGES

%

AVERAGE PERCENTAGE (Divide total percentages by the number of percentages used.) Enter on

0.00%

Step 5

Worksheet B above.

%

- 2 -

1

1 2

2