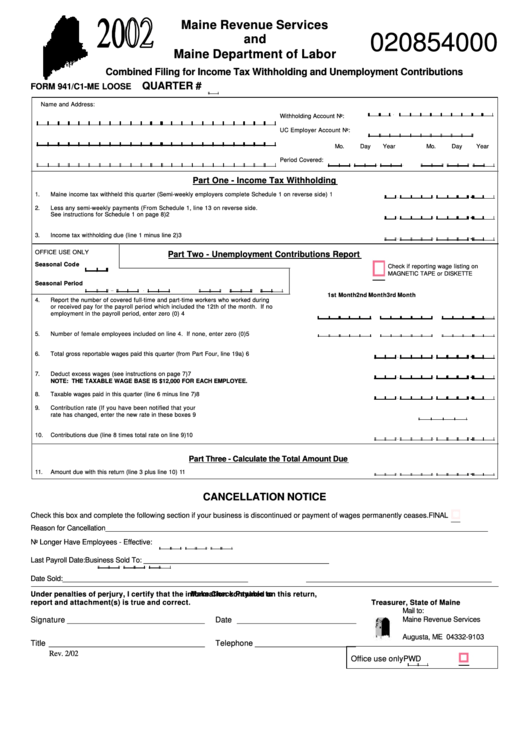

Form 941/c1-Me - Combined Filing For Income Tax Withholding And Unemployment Contributions - 2002

ADVERTISEMENT

Maine Revenue Services

020854000

and

Maine Department of Labor

Combined Filing for Income Tax Withholding and Unemployment Contributions

QUARTER #

FORM 941/C1-ME LOOSE

Name and Address:

Withholding Account No:

-

UC Employer Account No:

Mo.

Day

Year

Mo.

Day

Year

Period Covered:

-

-

-

-

-

Part One - Income Tax Withholding

1.

Maine income tax withheld this quarter (Semi-weekly employers complete Schedule 1 on reverse side) ................... 1

.

,

,

2.

Less any semi-weekly payments (From Schedule 1, line 13 on reverse side.

See instructions for Schedule 1 on page 8) ...................................................................................................... 2

.

,

,

3.

Income tax withholding due (line 1 minus line 2) ............................................................................................... 3

.

,

,

OFFICE USE ONLY

Part Two - Unemployment Contributions Report

Seasonal Code

Check if reporting wage listing on

MAGNETIC TAPE or DISKETTE

Seasonal Period

-

-

-

-

-

1st Month

2nd Month

3rd Month

4.

Report the number of covered full-time and part-time workers who worked during

or received pay for the payroll period which included the 12th of the month. If no

employment in the payroll period, enter zero (0) ................................................................ 4

5.

Number of female employees included on line 4. If none, enter zero (0) .............................. 5

6.

Total gross reportable wages paid this quarter (from Part Four, line 19a) .......................................................... 6

.

,

,

7.

Deduct excess wages (see instructions on page 7) ....................................................................................... 7

.

,

,

NOTE: THE TAXABLE WAGE BASE IS $12,000 FOR EACH EMPLOYEE.

8.

Taxable wages paid in this quarter (line 6 minus line 7) .................................................................................. 8

.

,

,

9.

Contribution rate (If you have been notified that your

rate has changed, enter the new rate in these boxes ..................................................................................... 9

10.

Contributions due (line 8 times total rate on line 9) ...................................................................................... 10

.

,

,

Part Three - Calculate the Total Amount Due

.

11.

Amount due with this return (line 3 plus line 10) .......................................................................................... 11

,

,

CANCELLATION NOTICE

Check this box and complete the following section if your business is discontinued or payment of wages permanently ceases.

FINAL

Reason for Cancellation _________________________________________________________________________________________________

No Longer Have Employees - Effective:

-

-

Last Payroll Date:

Business Sold To: _______________________________________________

-

-

Date Sold: _______________________________________________

_______________________________________________

Under penalties of perjury, I certify that the information contained on this return,

Make Check Payable to

report and attachment(s) is true and correct.

Treasurer, State of Maine

Mail to:

Signature ______________________________

Date __________________________

Maine Revenue Services

P.O. Box 9103

Augusta, ME 04332-9103

Title __________________________________

Telephone ______________________

Rev. 2/02

Office use only

PWD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3