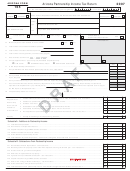

Form 60 Draft - S Corporation Income Tax Return - 2007 Page 4

ADVERTISEMENT

DRAFT 10/30/2007

North Dakota Office of State Tax Commissioner

2007 Form 60, page 4

Schedule K continued...

Line 23 applies to all corporations—see instructions

23

For disposition(s) of I.R.C. Section 179 property, enter the North Dakota apportioned amounts—see instructions:

a

23a

Gross sales price or amount realized........................................................................................................................

b

23b

Cost or other basis plus expense of sale...................................................................................................................

c

23c

Depreciation allowed or allowable (excluding I.R.C. Section 179 deduction).........................................................

d

23d

I.R.C. Section 179 deduction related to property that was passed through to shareholders .....................................

Line 24 applies to all corporations—see instructions

24 a

Total 2006 real estate taxes and 2007 mobile home taxes paid on all directly owned commercial properties

24a

located in North Dakota ...........................................................................................................................................

b

Corporation’s share of 2006 real estate taxes and 2007 mobile home taxes on North Dakota commercial

24b

property paid by another passthrough entity in which the corporation held an interest ...........................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6