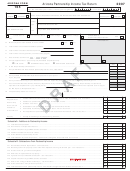

Form 60 Draft - S Corporation Income Tax Return - 2007 Page 5

ADVERTISEMENT

DRAFT 10/30/2007

North Dakota Office of State Tax Commissioner

2007 Form 60, page 5

Schedule KS

Shareholder information

Complete Columns 1 through 5 for EVERY shareholder

All corporations must

complete this schedule

Complete Column 6 if shareholder is a nonresident individual, estate, or trust

If applicable, complete Column 7 or Column 8 for nonresident individual shareholder only

All Shareholders

Column 1

Column 2

Column 3

Column 4

Share-

Name and address of shareholder

If additional lines are needed,

Social Security

Type of entity

Ownership

attach additional pages

holder

Number / FEIN

%

(See pg. 7 of instr.)

Name

A

Address

Name

B

Address

Name

C

Address

Name

D

Address

Name

E

Address

Name

F

Address

Name

G

Address

Nonresident Shareholders Only

Individuals, estates,

Individuals only

All Shareholders

and trusts

Column 5

Column 6

Column 7

Column 8

North Dakota

North Dakota

Form

North Dakota

Federal distributive

PWA

distributive share of

income tax

composite income tax

share of income (loss)

income (loss)

withheld

(5.54%)

Shareholder

(5.54%)

A

B

C

D

E

F

G

1

1

Total for Column 5 ..

2

2

Total for Column 6 .............................................

3

3

Total for Column 7. Enter this amount on Form 60, page 1, line 2 ...............

4

4

Total for Column 8. Enter this amount on Form 60, page 1, line 3 ......................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6