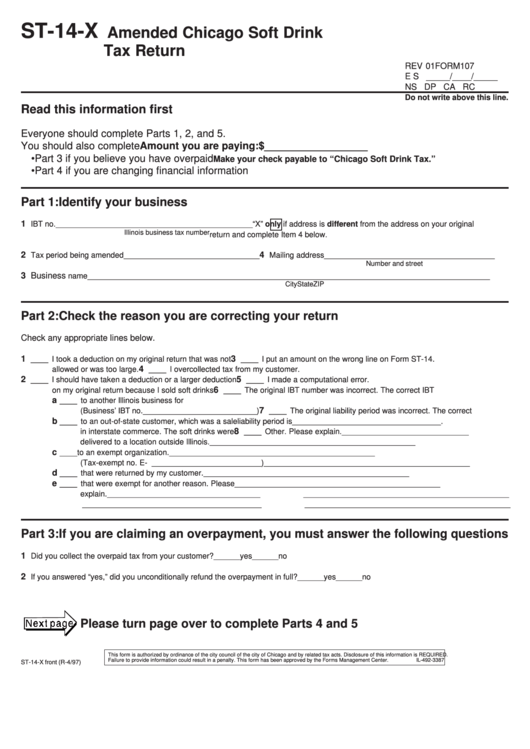

ST-14-X

Amended Chicago Soft Drink

Tax Return

REV 01

FORM 107

E S _____/____/_____

NS DP CA RC

Do not write above this line.

Read this information first

Everyone should complete Parts 1, 2, and 5.

You should also complete

Amount you are paying: $__________________

• Part 3 if you believe you have overpaid

Make your check payable to “Chicago Soft Drink Tax.”

• Part 4 if you are changing financial information

Part 1: Identify your business

1

IBT no.

_____________________________________________

“X” only if address is different from the address on your original

Illinois business tax number

return and complete Item 4 below.

2

4

Tax period being amended _______________________________

Mailing address _______________________________________

Number and street

3 Business

name _______________________________________

_____________________________________________________

City

State

ZIP

Part 2: Check the reason you are correcting your return

Check any appropriate lines below.

1

3

____ I took a deduction on my original return that was not

____ I put an amount on the wrong line on Form ST-14.

4

allowed or was too large.

____ I overcollected tax from my customer.

2

5

____ I should have taken a deduction or a larger deduction

____ I made a computational error.

6

on my original return because I sold soft drinks

____ The original IBT number was incorrect. The correct IBT

a

____ to another Illinois business for resale.

number is ______________________________________.

7

(Business’ IBT no. __________________________)

____ The original liability period was incorrect. The correct

b

____ to an out-of-state customer, which was a sale

liability period is __________________________________.

8

in interstate commerce. The soft drinks were

____ Other. Please explain. _____________________________

delivered to a location outside Illinois.

_______________________________________________

c

____ to an exempt organization.

_______________________________________________

(Tax-exempt no. E- _________________________)

_______________________________________________

d

____ that were returned by my customer.

_______________________________________________

e

____ that were exempt for another reason. Please

_______________________________________________

explain. ___________________________________

_______________________________________________

_________________________________________

_______________________________________________

Part 3: If you are claiming an overpayment, you must answer the following questions

1

Did you collect the overpaid tax from your customer?

______ yes

______ no

2

If you answered “yes,” did you unconditionally refund the overpayment in full? ______ yes

______ no

Please turn page over to complete Parts 4 and 5

This form is authorized by ordinance of the city council of the city of Chicago and by related tax acts. Disclosure of this information is REQUIRED.

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3387

ST-14-X front (R-4/97)

1

1 2

2