Form St-14 - Chicago Soft Drink Tax Return

ADVERTISEMENT

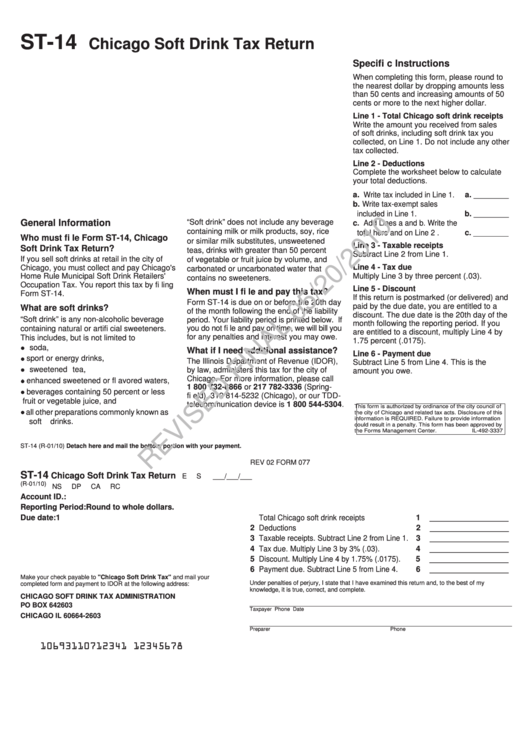

ST-14

Chicago Soft Drink Tax Return

Specifi c Instructions

When completing this form, please round to

the nearest dollar by dropping amounts less

than 50 cents and increasing amounts of 50

cents or more to the next higher dollar.

Line 1 - Total Chicago soft drink receipts

Write the amount you received from sales

of soft drinks, including soft drink tax you

collected, on Line 1. Do not include any other

tax collected.

Line 2 - Deductions

Complete the worksheet below to calculate

your total deductions.

a. Write tax included in Line 1.

a. ________

b. Write tax-exempt sales

included in Line 1.

b. ________

General Information

“Soft drink” does not include any beverage

c. Add Lines a and b. Write the

containing milk or milk products, soy, rice

total here and on Line 2 .

c. ________

Who must fi le Form ST-14, Chicago

or similar milk substitutes, unsweetened

Line 3 - Taxable receipts

Soft Drink Tax Return?

teas, drinks with greater than 50 percent

Subtract Line 2 from Line 1.

If you sell soft drinks at retail in the city of

of vegetable or fruit juice by volume, and

Line 4 - Tax due

Chicago, you must collect and pay Chicago's

carbonated or uncarbonated water that

Home Rule Municipal Soft Drink Retailers'

Multiply Line 3 by three percent (.03).

contains no sweeteners.

Occupation Tax. You report this tax by fi ling

Line 5 - Discount

When must I fi le and pay this tax?

Form ST-14.

If this return is postmarked (or delivered) and

Form ST-14 is due on or before the 20th day

paid by the due date, you are entitled to a

What are soft drinks?

of the month following the end of the liability

discount. The due date is the 20th day of the

“Soft drink” is any non-alcoholic beverage

period. Your liability period is printed below. If

month following the reporting period. If you

you do not fi le and pay on time, we will bill you

containing natural or artifi cial sweeteners.

are entitled to a discount, multiply Line 4 by

for any penalties and interest you may owe.

This includes, but is not limited to

1.75 percent (.0175).

soda,

What if I need additional assistance?

Line 6 - Payment due

sport or energy drinks,

The Illinois Department of Revenue (IDOR),

Subtract Line 5 from Line 4. This is the

sweetened tea,

by law, administers this tax for the city of

amount you owe.

Chicago. For more information, please call

enhanced sweetened or fl avored waters,

1 800 732-8866 or 217 782-3336 (Spring-

beverages containing 50 percent or less

fi eld), 312 814-5232 (Chicago), or our TDD-

fruit or vegetable juice, and

telecommunication device is 1 800 544-5304.

This form is authorized by ordinance of the city council of

all other preparations commonly known as

the city of Chicago and related tax acts. Disclosure of this

information is REQUIRED. Failure to provide information

soft drinks.

could result in a penalty. This form has been approved by

the Forms Management Center.

IL-492-3337

ST-14 (R-01/10)

Detach here and mail the bottom portion with your payment.

REV 02

FORM 077

ST-14

Chicago Soft Drink Tax Return

E

S

___/___/___

(R-01/10)

NS

DP

CA

RC

Account ID.:

Reporting Period:

Round to whole dollars.

Due date:

1 Total Chicago soft drink receipts

1

__________________

2 Deductions

2

__________________

3 Taxable receipts. Subtract Line 2 from Line 1.

3

__________________

4 Tax due. Multiply Line 3 by 3% (.03).

4

__________________

5 Discount. Multiply Line 4 by 1.75% (.0175).

5

__________________

6 Payment due. Subtract Line 5 from Line 4.

6

__________________

Make your check payable to "Chicago Soft Drink Tax" and mail your

Under penalties of perjury, I state that I have examined this return and, to the best of my

completed form and payment to IDOR at the following address:

knowledge, it is true, correct, and complete.

CHICAGO SOFT DRINK TAX ADMINISTRATION

_____________________________________________________________________________

PO BOX 642603

Taxpayer

Phone

Date

CHICAGO IL 60664-2603

_____________________________________________________________________________

Preparer

Phone

Date

10693110712341 12345678

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1