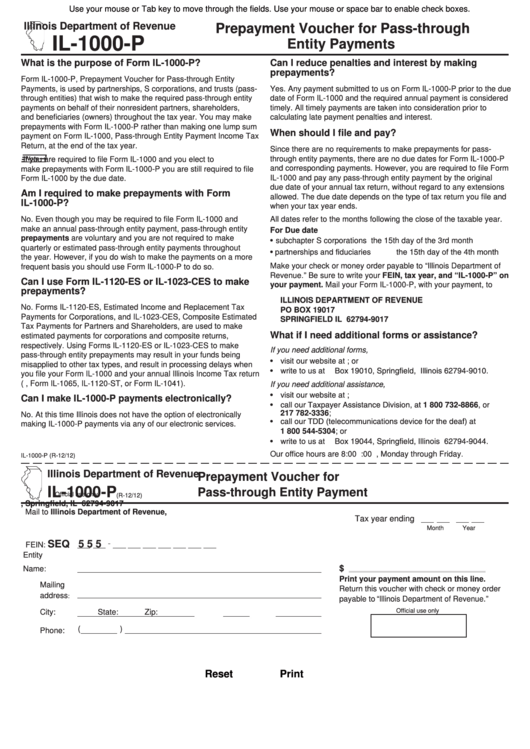

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Prepayment Voucher for Pass-through

IL-1000-P

Entity Payments

What is the purpose of Form IL-1000-P?

Can I reduce penalties and interest by making

prepayments?

Form IL-1000-P, Prepayment Voucher for Pass-through Entity

Payments, is used by partnerships, S corporations, and trusts (pass-

Yes. Any payment submitted to us on Form IL-1000-P prior to the due

through entities) that wish to make the required pass-through entity

date of Form IL-1000 and the required annual payment is considered

payments on behalf of their nonresident partners, shareholders,

timely. All timely payments are taken into consideration prior to

and beneficiaries (owners) throughout the tax year. You may make

calculating late payment penalties and interest.

prepayments with Form IL-1000-P rather than making one lump sum

When should I file and pay?

payment on Form IL-1000, Pass-through Entity Payment Income Tax

Return, at the end of the tax year.

Since there are no requirements to make prepayments for pass-

through entity payments, there are no due dates for Form IL-1000-P

If you are required to file Form IL-1000 and you elect to

and corresponding payments. However, you are required to file Form

make prepayments with Form IL-1000-P you are still required to file

IL-1000 and pay any pass-through entity payment by the original

Form IL-1000 by the due date.

due date of your annual tax return, without regard to any extensions

Am I required to make prepayments with Form

allowed. The due date depends on the type of tax return you file and

IL-1000-P?

when your tax year ends.

No. Even though you may be required to file Form IL-1000 and

All dates refer to the months following the close of the taxable year.

make an annual pass-through entity payment, pass-through entity

For

Due date

prepayments are voluntary and you are not required to make

• subchapter S corporations

the 15th day of the 3rd month

quarterly or estimated pass-through entity payments throughout

• partnerships and fiduciaries

the 15th day of the 4th month

the year. However, if you do wish to make the payments on a more

Make your check or money order payable to “Illinois Department of

frequent basis you should use Form IL-1000-P to do so.

Revenue.” Be sure to write your FEIN, tax year, and “IL-1000-P” on

Can I use Form IL-1120-ES or IL-1023-CES to make

your payment. Mail your Form IL-1000-P, with your payment, to

prepayments?

ILLINOIS DEPARTMENT OF REVENUE

No. Forms IL-1120-ES, Estimated Income and Replacement Tax

PO BOX 19017

Payments for Corporations, and IL-1023-CES, Composite Estimated

SPRINGFIELD IL 62794-9017

Tax Payments for Partners and Shareholders, are used to make

What if I need additional forms or assistance?

estimated payments for corporations and composite returns,

respectively. Using Forms IL-1120-ES or IL-1023-CES to make

If you need additional forms,

pass-through entity prepayments may result in your funds being

• visit our website at tax.illinois.gov; or

misapplied to other tax types, and result in processing delays when

• write to us at P.O. Box 19010, Springfield, Illinois 62794-9010.

you file your Form IL-1000 and your annual Illinois Income Tax return

(i.e., Form IL-1065, IL-1120-ST, or Form IL-1041).

If you need additional assistance,

• visit our website at tax.illinois.gov;

Can I make IL-1000-P payments electronically?

• call our Taxpayer Assistance Division, at 1 800 732-8866, or

217 782-3336;

No. At this time Illinois does not have the option of electronically

• call our TDD (telecommunications device for the deaf) at

making IL-1000-P payments via any of our electronic services.

1 800 544-5304; or

• write to us at P.O. Box 19044, Springfield, Illinois 62794-9044.

Our office hours are 8:00 a.m. to 5:00 p.m., Monday through Friday.

IL-1000-P (R-12/12)

Illinois Department of Revenue

Prepayment Voucher for

IL-1000-P

Pass-through Entity Payment

(R-12/12)

Official use only

Mail to Illinois Department of Revenue,

Tax year ending

P.O. Box 19017, Springfield, IL 62794-9017

Month

Year

SEQ 5 5 5

FEIN:

Entity

$

Name:

Print your payment amount on this line.

Mailing

Return this voucher with check or money order

address

:

payable to “Illinois Department of Revenue.”

Official use only

City:

State:

Zip:

(

)

Phone:

Print

Reset

1

1