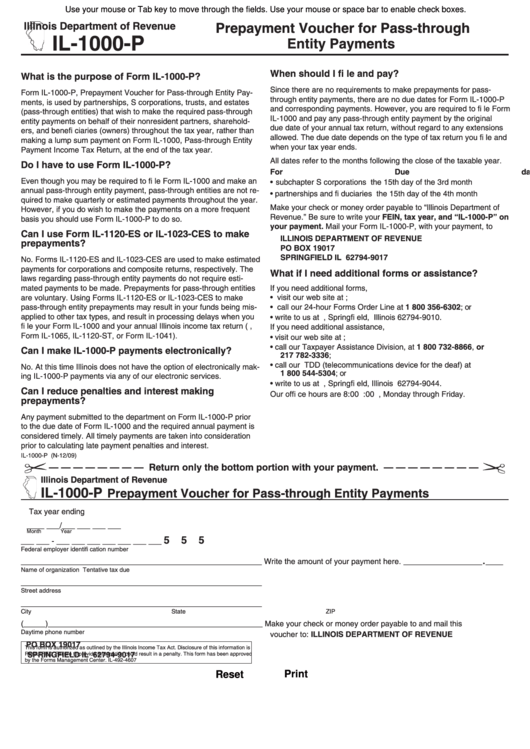

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Prepayment Voucher for Pass-through

IL-1000-P

Entity Payments

When should I fi le and pay?

What is the purpose of Form IL-1000-P?

Since there are no requirements to make prepayments for pass-

Form IL-1000-P, Prepayment Voucher for Pass-through Entity Pay-

through entity payments, there are no due dates for Form IL-1000-P

ments, is used by partnerships, S corporations, trusts, and estates

and corresponding payments. However, you are required to fi le Form

(pass-through entities) that wish to make the required pass-through

IL-1000 and pay any pass-through entity payment by the original

entity payments on behalf of their nonresident partners, sharehold-

due date of your annual tax return, without regard to any extensions

ers, and benefi ciaries (owners) throughout the tax year, rather than

allowed. The due date depends on the type of tax return you fi le and

making a lump sum payment on Form IL-1000, Pass-through Entity

when your tax year ends.

Payment Income Tax Return, at the end of the tax year.

All dates refer to the months following the close of the taxable year.

Do I have to use Form IL-1000-P?

For

Due date

Even though you may be required to fi le Form IL-1000 and make an

• subchapter S corporations

the 15th day of the 3rd month

annual pass-through entity payment, pass-through entities are not re-

• partnerships and fi duciaries

the 15th day of the 4th month

quired to make quarterly or estimated payments throughout the year.

Make your check or money order payable to “Illinois Department of

However, if you do wish to make the payments on a more frequent

Revenue.” Be sure to write your FEIN, tax year, and “IL-1000-P” on

basis you should use Form IL-1000-P to do so.

your payment. Mail your Form IL-1000-P, with your payment, to

Can I use Form IL-1120-ES or IL-1023-CES to make

ILLINOIS DEPARTMENT OF REVENUE

prepayments?

PO BOX 19017

SPRINGFIELD IL 62794-9017

No. Forms IL-1120-ES and IL-1023-CES are used to make estimated

payments for corporations and composite returns, respectively. The

What if I need additional forms or assistance?

laws regarding pass-through entity payments do not require esti-

mated payments to be made. Prepayments for pass-through entities

If you need additional forms,

• visit our web site at tax.illinois.gov;

are voluntary. Using Forms IL-1120-ES or IL-1023-CES to make

pass-through entity prepayments may result in your funds being mis-

• call our 24-hour Forms Order Line at 1 800 356-6302; or

applied to other tax types, and result in processing delays when you

• write to us at P.O. Box 19010, Springfi eld, Illinois 62794-9010.

fi le your Form IL-1000 and your annual Illinois income tax return (i.e.,

If you need additional assistance,

Form IL-1065, IL-1120-ST, or Form IL-1041).

• visit our web site at tax.illinois.gov;

• call our Taxpayer Assistance Division, at 1 800 732-8866, or

Can I make IL-1000-P payments electronically?

217 782-3336;

• call our TDD (telecommunications device for the deaf) at

No. At this time Illinois does not have the option of electronically mak-

1 800 544-5304; or

ing IL-1000-P payments via any of our electronic services.

• write to us at P.O. Box 19044, Springfi eld, Illinois 62794-9044.

Can I reduce penalties and interest making

Our offi ce hours are 8:00 a.m. to 5:00 p.m., Monday through Friday.

prepayments?

Any payment submitted to the department on Form IL-1000-P prior

to the due date of Form IL-1000 and the required annual payment is

considered timely. All timely payments are taken into consideration

prior to calculating late payment penalties and interest.

IL-1000-P (N-12/09)

— — — — — — — — Return only the bottom portion with your payment. — — — — — — — —

Illinois Department of Revenue

IL-1000-P

Prepayment Voucher for Pass-through Entity Payments

Tax year ending

____ ___/___ ___ ___ ___

Month

Year

5

5

5

___ ___ - ___ ___ ___ ___ ___ ___ ___

Federal employer identifi cation number

.

_______________________________________________________

Write the amount of your payment here. __________________

____

Name of organization

Tentative tax due

_______________________________________________________

Street address

_______________________________________________________

City

State

ZIP

(_____)_________________________________________________

Make your check or money order payable to and mail this

Daytime phone number

voucher to:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19017

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is

REQUIRED. Failure to provide information could result in a penalty. This form has been approved

SPRINGFIELD IL 62794-9017

by the Forms Management Center.

IL-492-4607

Print

Reset

1

1