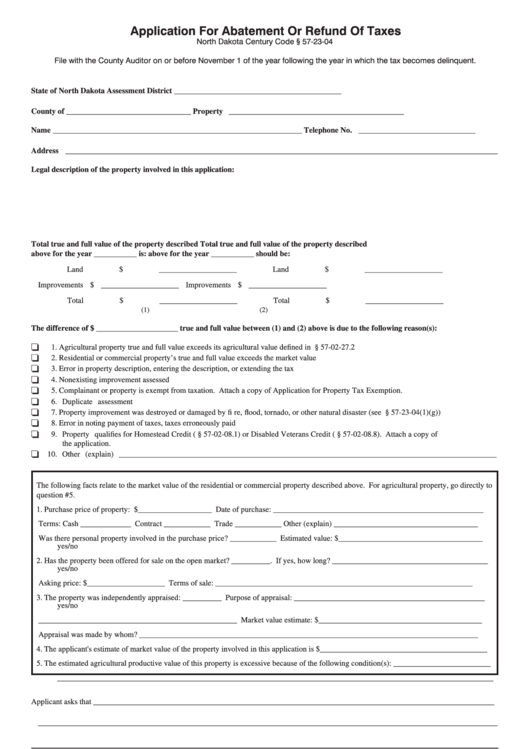

Application For Abatement Or Refund Of Taxes

North Dakota Century Code § 57-23-04

File with the County Auditor on or before November 1 of the year following the year in which the tax becomes delinquent.

State of North Dakota

Assessment District ___________________________________________

County of ________________________________

Property I.D. No. _____________________________________________

Name ________________________________________________________________

Telephone No. ______________________________

Address _______________________________________________________________________________________________________________

Legal description of the property involved in this application:

Total true and full value of the property described

Total true and full value of the property described

above for the year ___________ is:

above for the year ___________ should be:

Land

$ ____________________

Land

$ ____________________

Improvements $ ____________________

Improvements $ ____________________

Total

$ ____________________

Total

$ ____________________

(1)

(2)

The difference of $ _____________________ true and full value between (1) and (2) above is due to the following reason(s):

1. Agricultural property true and full value exceeds its agricultural value defi ned in N.D.C.C. § 57-02-27.2

2. Residential or commercial property’s true and full value exceeds the market value

3. Error in property description, entering the description, or extending the tax

4. Nonexisting improvement assessed

5. Complainant or property is exempt from taxation. Attach a copy of Application for Property Tax Exemption.

6. Duplicate assessment

7. Property improvement was destroyed or damaged by fi re, fl ood, tornado, or other natural disaster (see N.D.C.C. § 57-23-04(1)(g))

8. Error in noting payment of taxes, taxes erroneously paid

9. Property qualifi es for Homestead Credit (N.D.C.C. § 57-02-08.1) or Disabled Veterans Credit (N.D.C.C. § 57-02-08.8). Attach a copy of

the application.

10. Other (explain)

_________________________________________________________________________________________________

The following facts relate to the market value of the residential or commercial property described above. For agricultural property, go directly to

question #5.

1. Purchase price of property: $___________________ Date of purchase: ______________________________________________________

Terms: Cash _____________ Contract ____________ Trade ____________ Other (explain) _____________________________________

Was there personal property involved in the purchase price? ____________ Estimated value: $_____________________________________

yes/no

2. Has the property been offered for sale on the open market? __________. If yes, how long? ________________________________________

yes/no

Asking price: $____________________ Terms of sale:

__________________________________________________________________

3. The property was independently appraised: __________ Purpose of appraisal: _________________________________________________

yes/no

___________________________________________________ Market value estimate: $__________________________________________

Appraisal was made by whom? _______________________________________________________________________________________

4. The applicant's estimate of market value of the property involved in this application is $___________________________________________

5. The estimated agricultural productive value of this property is excessive because of the following condition(s): _________________________

________________________________________________________________________________________________________________

Applicant asks that _______________________________________________________________________________________________________

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

By fi ling this application, I consent to an inspection of the above-described property by an authorized assessment offi cial for the purpose of making an

appraisal of the property. I understand the offi cial will give me reasonable notifi cation of the inspection. See N.D.C.C. § 57-23-05.1.

I declare under the penalties of N.D.C.C. § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental

matter, that this application is, to the best of my knowledge and belief, a true and correct application.

_______________________________________________ ___________

_____________________________________________ ___________

Signature of Preparer (if other than applicant)

Date

Signature of Applicant

Date

24775

(2-2016)

1

1 2

2