Form Mo-1040c Instructions For The Missouri Itemized Deductions

ADVERTISEMENT

your spouse’s part in the “Your Spouse” column. The following items are special points to keep in

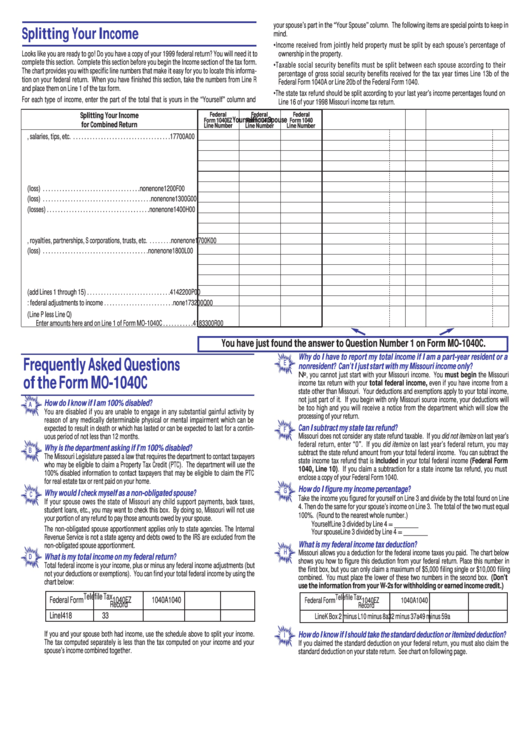

Splitting Your Income

mind.

• Income received from jointly held property must be split by each spouse’s percentage of

Looks like you are ready to go! Do you have a copy of your 1999 federal return? You will need it to

ownership in the property.

complete this section. Complete this section before you begin the Income section of the tax form.

• Taxable social security benefits must be split between each spouse according to their

The chart provides you with specific line numbers that make it easy for you to locate this informa-

percentage of gross social security benefits received for the tax year times Line 13b of the

tion on your federal return. When you have finished this section, take the numbers from Line R

Federal Form 1040A or Line 20b of the Federal Form 1040.

and place them on Line 1 of the tax form.

• The state tax refund should be split according to your last year’s income percentages found on

For each type of income, enter the part of the total that is yours in the “Yourself” column and

Line 16 of your 1998 Missouri income tax return.

Federal

Federal

Federal

Splitting Your Income

Yourself

Your Spouse

Form 1040EZ

Form 1040A

Form 1040

for Combined Return

Line Number

Line Number

Line Number

A. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

7

7

00

A

00

B. Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

8a

8a

00

B

00

C. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

9

9

00

C

00

D. State and local income tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

10

00

D

00

E. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

11

00

E

00

F. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

12

00

F

00

G. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

13

00

G

00

H. Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

14

00

H

00

I. Taxable IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

10b

15b

00

I

00

J. Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

11b

16b

00

J

00

K. Rents, royalties, partnerships, S corporations, trusts, etc. . . . . . . . .

none

none

17

00

K

00

L. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

18

00

L

00

M. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

12

19

00

M

00

N. Taxable social security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

13b

20b

00

N

00

O. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

21

00

O

00

P. Total (add Lines 1 through 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

14

22

00

P

00

Q. Less: federal adjustments to income . . . . . . . . . . . . . . . . . . . . . . . . .

none

17

32

00

Q

00

R. Federal adjusted gross income (Line P less Line Q)

Enter amounts here and on Line 1 of Form MO-1040C . . . . . . . . . . .

4

18

33

00

R

00

You have just found the answer to Question Number 1 on Form MO-1040C.

Why do I have to report my total income if I am a part-year resident or a

Frequently Asked Questions

E

nonresident? Can’t I just start with my Missouri income only?

No, you cannot just start with your Missouri income. You must begin the Missouri

of the Form MO-1040C

income tax return with your total federal income, even if you have income from a

state other than Missouri. Your deductions and exemptions apply to your total income,

not just part of it. If you begin with only Missouri source income, your deductions will

How do I know if I am 100% disabled?

A

be too high and you will receive a notice from the department which will slow the

You are disabled if you are unable to engage in any substantial gainful activity by

processing of your return.

reason of any medically determinable physical or mental impairment which can be

Can I subtract my state tax refund?

expected to result in death or which has lasted or can be expected to last for a contin-

F

Missouri does not consider any state refund taxable. If you did not itemize on last year’s

uous period of not less than 12 months.

federal return, enter “0”. If you did itemize on last year’s federal return, you may

Why is the department asking if I’m 100% disabled?

B

subtract the state refund amount from your total federal income. You can subtract the

The Missouri Legislature passed a law that requires the department to contact taxpayers

state income tax refund that is included in your total federal income (Federal Form

who may be eligible to claim a Property Tax Credit (PTC). The department will use the

1040, Line 10). If you claim a subtraction for a state income tax refund, you must

100% disabled information to contact taxpayers that may be eligible to claim the PTC

enclose a copy of your Federal Form 1040.

for real estate tax or rent paid on your home.

How do I figure my income percentage?

G

Why would I check myself as a non-obligated spouse?

C

Take the income you figured for yourself on Line 3 and divide by the total found on Line

If your spouse owes the state of Missouri any child support payments, back taxes,

4. Then do the same for your spouse’s income on Line 3. The total of the two must equal

student loans, etc., you may want to check this box. By doing so, Missouri will not use

100%. (Round to the nearest whole number.)

your portion of any refund to pay those amounts owed by your spouse.

Yourself

Line 3 divided by Line 4 = ______

The non-obligated spouse apportionment applies only to state agencies. The Internal

Your spouse

Line 3 divided by Line 4 = ______

Revenue Service is not a state agency and debts owed to the IRS are excluded from the

What is my federal income tax deduction?

non-obligated spouse apportionment.

H

Missouri allows you a deduction for the federal income taxes you paid. The chart below

D

What is my total income on my federal return?

shows you how to figure this deduction from your federal return. Place this number in

Total federal income is your income, plus or minus any federal income adjustments (but

the first box, but you can only claim a maximum of $5,000 filing single or $10,000 filing

not your deductions or exemptions). You can find your total federal income by using the

combined. You must place the lower of these two numbers in the second box. (Don’t

chart below:

use the information from your W-2s for withholding or earned income credit.)

Telefile Tax

Telefile Tax

Federal Form

1040EZ

1040A

1040

Federal Form

1040EZ

1040A

1040

Record

Record

Line

I

4

18

33

Line

K Box 2 minus L

10 minus 8a

32 minus 37a

49 minus 59a

If you and your spouse both had income, use the schedule above to split your income.

How do I know if I should take the standard deduction or itemized deduction?

I

The tax computed separately is less than the tax computed on your income and your

If you claimed the standard deduction on your federal return, you must also claim the

spouse’s income combined together.

standard deduction on your state return. See chart on following page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2