Form Mo 1040a Instructions - Missouri Itemized Deductions

ADVERTISEMENT

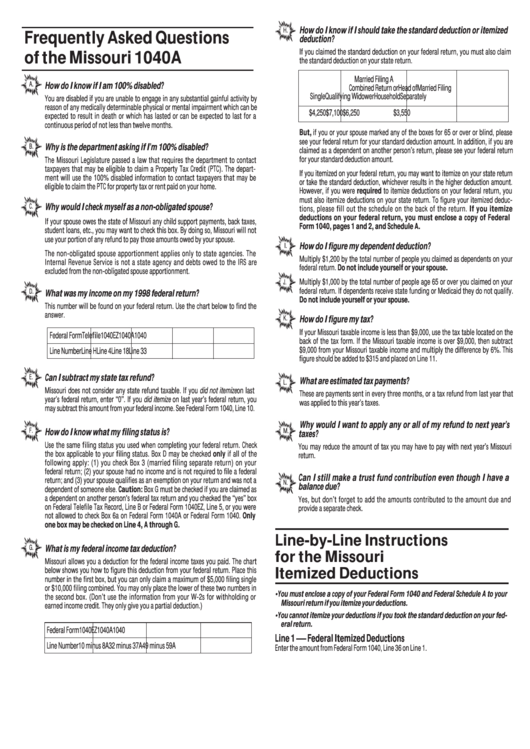

How do I know if I should take the standard deduction or itemized

H.

Frequently Asked Questions

deduction?

If you claimed the standard deduction on your federal return, you must also claim

of the Missouri 1040A

the standard deduction on your state return.

Married Filing A

A.

How do I know if I am 100% disabled?

Combined Return or

Head of

Married Filing

Single

Qualifying Widower

Household

Separately

You are disabled if you are unable to engage in any substantial gainful activity by

reason of any medically determinable physical or mental impairment which can be

$4,250

$7,100

$6,250

$3,550

expected to result in death or which has lasted or can be expected to last for a

continuous period of not less than twelve months.

But, if you or your spouse marked any of the boxes for 65 or over or blind, please

see your federal return for your standard deduction amount. In addition, if you are

B.

Why is the department asking if I’m 100% disabled?

claimed as a dependent on another person’s return, please see your federal return

for your standard deduction amount.

The Missouri Legislature passed a law that requires the department to contact

taxpayers that may be eligible to claim a Property Tax Credit (PTC). The depart-

If you itemized on your federal return, you may want to itemize on your state return

ment will use the 100% disabled information to contact taxpayers that may be

or take the standard deduction, whichever results in the higher deduction amount.

eligible to claim the PTC for property tax or rent paid on your home.

However, if you were required to itemize deductions on your federal return, you

must also itemize deductions on your state return. To figure your itemized deduc-

C.

Why would I check myself as a non-obligated spouse?

tions, please fill out the schedule on the back of the return. If you itemize

deductions on your federal return, you must enclose a copy of Federal

If your spouse owes the state of Missouri any child support payments, back taxes,

Form 1040, pages 1 and 2, and Schedule A.

student loans, etc., you may want to check this box. By doing so, Missouri will not

use your portion of any refund to pay those amounts owed by your spouse.

How do I figure my dependent deduction?

I.

The non-obligated spouse apportionment applies only to state agencies. The

Multiply $1,200 by the total number of people you claimed as dependents on your

Internal Revenue Service is not a state agency and debts owed to the IRS are

federal return. Do not include yourself or your spouse.

excluded from the non-obligated spouse apportionment.

Multiply $1,000 by the total number of people age 65 or over you claimed on your

J.

federal return. If dependents receive state funding or Medicaid they do not qualify.

D.

What was my income on my 1998 federal return?

Do not include yourself or your spouse.

This number will be found on your federal return. Use the chart below to find the

answer.

K.

How do I figure my tax?

If your Missouri taxable income is less than $9,000, use the tax table located on the

Federal Form

Telefile

1040EZ

1040A

1040

back of the tax form. If the Missouri taxable income is over $9,000, then subtract

$9,000 from your Missouri taxable income and multiply the difference by 6%. This

Line Number

Line H

Line 4

Line 18

Line 33

figure should be added to $315 and placed on Line 11.

E.

Can I subtract my state tax refund?

What are estimated tax payments?

L.

Missouri does not consider any state refund taxable. If you did not itemize on last

These are payments sent in every three months, or a tax refund from last year that

year’s federal return, enter “0”. If you did itemize on last year’s federal return, you

was applied to this year’s taxes.

may subtract this amount from your federal income. See Federal Form 1040, Line 10.

Why would I want to apply any or all of my refund to next year’s

F.

M.

How do I know what my filing status is?

taxes?

Use the same filing status you used when completing your federal return. Check

You may reduce the amount of tax you may have to pay with next year’s Missouri

the box applicable to your filing status. Box D may be checked only if all of the

return.

following apply: (1) you check Box 3 (married filing separate return) on your

federal return; (2) your spouse had no income and is not required to file a federal

Can I still make a trust fund contribution even though I have a

return; and (3) your spouse qualifies as an exemption on your return and was not a

N.

balance due?

dependent of someone else. Caution: Box G must be checked if you are claimed as

a dependent on another person's federal tax return and you checked the “yes” box

Yes, but don’t forget to add the amounts contributed to the amount due and

on Federal Telefile Tax Record, Line B or Federal Form 1040EZ, Line 5, or you were

provide a separate check.

not allowed to check Box 6a on Federal Form 1040A or Federal Form 1040. Only

one box may be checked on Line 4, A through G.

Line-by-Line Instructions

G.

What is my federal income tax deduction?

for the Missouri

Missouri allows you a deduction for the federal income taxes you paid. The chart

below shows you how to figure this deduction from your federal return. Place this

Itemized Deductions

number in the first box, but you can only claim a maximum of $5,000 filing single

or $10,000 filing combined. You may only place the lower of these two numbers in

• You must enclose a copy of your Federal Form 1040 and Federal Schedule A to your

the second box. (Don’t use the information from your W-2s for withholding or

Missouri return if you itemize your deductions.

earned income credit. They only give you a partial deduction.)

• You cannot itemize your deductions if you took the standard deduction on your fed-

eral return.

Federal Form

1040EZ

1040A

1040

Line 1 — Federal Itemized Deductions

Line Number

10 minus 8A

32 minus 37A

49 minus 59A

Enter the amount from Federal Form 1040, Line 36 on Line 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2