Ota Form 2 - Petition For Refund - West Virginia Offfice Of Tax Appeals Page 4

ADVERTISEMENT

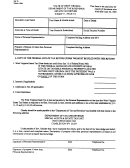

PETITION FOR REFUND

Pg.. 4 of ___ Pgs.

_______________

In a non-small claim case, a Petitioner may request, in the petition, to have his or her case

submitted for a written, appealable decision on documents only and without being heard in person.

This Petitioner desires to waive his or her right to be heard in person and to submit the

case for a written decision on documents only:

___ Yes

___ No

(check

one)

[To be completed by OTA: ____ Request granted

____ Request denied]

____________________

The West Virginia Office of Tax Appeals usually holds hearings in Charleston, West Virginia.

Occasionally, the Office of Tax Appeals may decide to hold hearings at certain regional locations in this

State, depending primarily upon the volume of cases requested to be heard in a region and the travel

budget. Please mark your requested preference for the hearing location:

____ Charleston

____ Bridgeport

____ Bluefield

____ Wheeling

____ Martinsburg

[To be completed by OTA: ____Request granted

____Request denied]

___________________

Certain cases may be eligible for more informal handling as small claim cases. Decisions in

small claim cases are final and conclusive and are NOT subject to any further administrative or judicial

review. A non-lawyer usually represents the State Tax Division in small claim cases.

Unless the West Virginia Office of Tax Appeals determines otherwise, small claim cases are

submitted on documents only and without a hearing in person.

A taxpayer may request handling of his or her case as a small claim if the amount in controversy

(excluding interest), for any one taxable year, does not exceed $10,000.

I request that my case, eligible for small claim treatment, be handled using small claim

procedures; I realize that the law does not allow me to appeal a small claim decision:

____

(check

if you request small claim treatment)

[To be completed by OTA: ____ Request granted

____Request denied]

Certain types of cases will be handled as small claim cases, without a request, unless the Office of

Tax Appeals determines otherwise. These types of cases include: (1) all cases in which the total amount of

the tax assessment or the total amount of the tax refund or credit claim is less than $1,000; (2) all cases

involving estimated tax assessments; (3) all business registration tax and corporate license tax assessment

or refund matters; and (4) all cases involving not the tax itself but only requests for waiver or abatement of

additions, penalties, or interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5