Instructions For Form 8957 - Foreign Account Tax Compliance Act (Fatca) Registration - 2013

ADVERTISEMENT

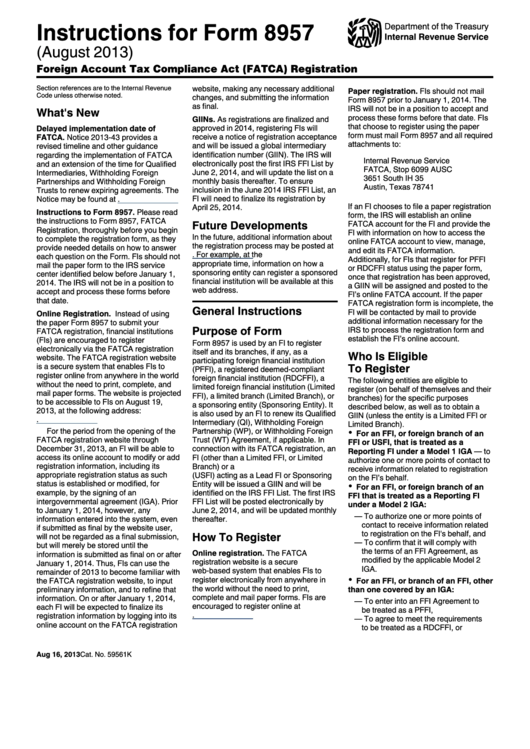

Instructions for Form 8957

Department of the Treasury

Internal Revenue Service

(August 2013)

Foreign Account Tax Compliance Act (FATCA) Registration

Section references are to the Internal Revenue

website, making any necessary additional

Paper registration. FIs should not mail

Code unless otherwise noted.

changes, and submitting the information

Form 8957 prior to January 1, 2014. The

as final.

IRS will not be in a position to accept and

What's New

process these forms before that date. FIs

GIINs. As registrations are finalized and

that choose to register using the paper

approved in 2014, registering FIs will

Delayed implementation date of

form must mail Form 8957 and all required

receive a notice of registration acceptance

FATCA. Notice 2013-43 provides a

attachments to:

and will be issued a global intermediary

revised timeline and other guidance

identification number (GIIN). The IRS will

regarding the implementation of FATCA

Internal Revenue Service

and an extension of the time for Qualified

electronically post the first IRS FFI List by

FATCA, Stop 6099 AUSC

June 2, 2014, and will update the list on a

Intermediaries, Withholding Foreign

3651 South IH 35

monthly basis thereafter. To ensure

Partnerships and Withholding Foreign

Austin, Texas 78741

inclusion in the June 2014 IRS FFI List, an

Trusts to renew expiring agreements. The

FI will need to finalize its registration by

Notice may be found at

If an FI chooses to file a paper registration

April 25, 2014.

Instructions to Form 8957. Please read

form, the IRS will establish an online

the instructions to Form 8957, FATCA

Future Developments

FATCA account for the FI and provide the

Registration, thoroughly before you begin

FI with information on how to access the

In the future, additional information about

to complete the registration form, as they

online FATCA account to view, manage,

the registration process may be posted at

provide needed details on how to answer

and edit its FATCA information.

For example, at the

each question on the Form. FIs should not

Additionally, for FIs that register for PFFI

appropriate time, information on how a

mail the paper form to the IRS service

or RDCFFI status using the paper form,

sponsoring entity can register a sponsored

center identified below before January 1,

once that registration has been approved,

financial institution will be available at this

2014. The IRS will not be in a position to

a GIIN will be assigned and posted to the

web address.

accept and process these forms before

FI’s online FATCA account. If the paper

that date.

FATCA registration form is incomplete, the

General Instructions

FI will be contacted by mail to provide

Online Registration. Instead of using

additional information necessary for the

the paper Form 8957 to submit your

Purpose of Form

IRS to process the registration form and

FATCA registration, financial institutions

establish the FI’s online account.

(FIs) are encouraged to register

Form 8957 is used by an FI to register

electronically via the FATCA registration

itself and its branches, if any, as a

Who Is Eligible

website. The FATCA registration website

participating foreign financial institution

To Register

is a secure system that enables FIs to

(PFFI), a registered deemed-compliant

register online from anywhere in the world

foreign financial institution (RDCFFI), a

The following entities are eligible to

without the need to print, complete, and

limited foreign financial institution (Limited

register (on behalf of themselves and their

mail paper forms. The website is projected

FFI), a limited branch (Limited Branch), or

branches) for the specific purposes

to be accessible to FIs on August 19,

a sponsoring entity (Sponsoring Entity). It

described below, as well as to obtain a

2013, at the following address:

is also used by an FI to renew its Qualified

GIIN (unless the entity is a Limited FFI or

Intermediary (QI), Withholding Foreign

Limited Branch).

For the period from the opening of the

Partnership (WP), or Withholding Foreign

For an FFI, or foreign branch of an

FATCA registration website through

Trust (WT) Agreement, if applicable. In

FFI or USFI, that is treated as a

December 31, 2013, an FI will be able to

connection with its FATCA registration, an

Reporting FI under a Model 1 IGA — to

access its online account to modify or add

FI (other than a Limited FFI, or Limited

authorize one or more points of contact to

registration information, including its

Branch) or a U.S. financial institution

receive information related to registration

appropriate registration status as such

(USFI) acting as a Lead FI or Sponsoring

on the FI’s behalf.

status is established or modified, for

Entity will be issued a GIIN and will be

For an FFI, or foreign branch of an

example, by the signing of an

identified on the IRS FFI List. The first IRS

FFI that is treated as a Reporting FI

intergovernmental agreement (IGA). Prior

FFI List will be posted electronically by

under a Model 2 IGA:

to January 1, 2014, however, any

June 2, 2014, and will be updated monthly

— To authorize one or more points of

information entered into the system, even

thereafter.

contact to receive information related

if submitted as final by the website user,

to registration on the FI's behalf, and

How To Register

will not be regarded as a final submission,

— To confirm that it will comply with

but will merely be stored until the

the terms of an FFI Agreement, as

Online registration. The FATCA

information is submitted as final on or after

modified by the applicable Model 2

registration website is a secure

January 1, 2014. Thus, FIs can use the

IGA.

web-based system that enables FIs to

remainder of 2013 to become familiar with

register electronically from anywhere in

the FATCA registration website, to input

For an FFI, or branch of an FFI, other

the world without the need to print,

preliminary information, and to refine that

than one covered by an IGA:

complete and mail paper forms. FIs are

information. On or after January 1, 2014,

— To enter into an FFI Agreement to

encouraged to register online at

each FI will be expected to finalize its

be treated as a PFFI,

registration information by logging into its

— To agree to meet the requirements

online account on the FATCA registration

to be treated as a RDCFFI, or

Aug 16, 2013

Cat. No. 59561K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7