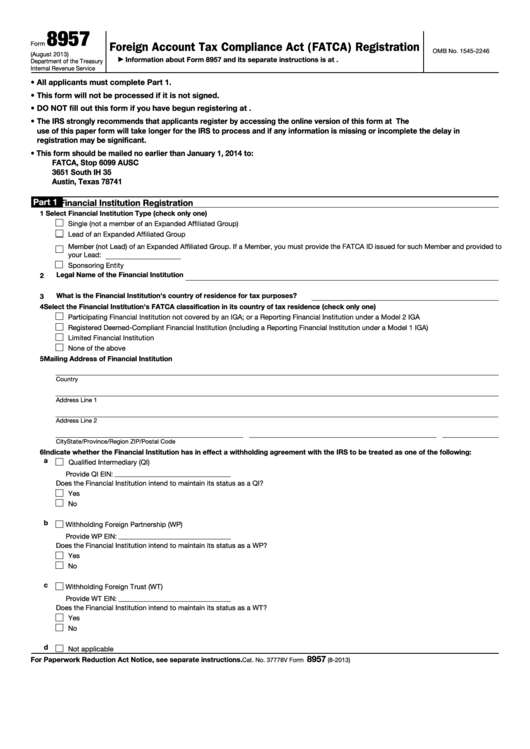

8957

Foreign Account Tax Compliance Act (FATCA) Registration

Form

OMB No. 1545-2246

(August 2013)

Department of the Treasury

Information about Form 8957 and its separate instructions is at

▶

Internal Revenue Service

• All applicants must complete Part 1.

• This form will not be processed if it is not signed.

• DO NOT fill out this form if you have begun registering at

• The IRS strongly recommends that applicants register by accessing the online version of this form at The

use of this paper form will take longer for the IRS to process and if any information is missing or incomplete the delay in

registration may be significant.

• This form should be mailed no earlier than January 1, 2014 to:

FATCA, Stop 6099 AUSC

3651 South IH 35

Austin, Texas 78741

Part 1

Financial Institution Registration

1

Select Financial Institution Type (check only one)

Single (not a member of an Expanded Affiliated Group)

Lead of an Expanded Affiliated Group

Member (not Lead) of an Expanded Affiliated Group. If a Member, you must provide the FATCA ID issued for such Member and provided to

your Lead:

Sponsoring Entity

Legal Name of the Financial Institution

2

What is the Financial Institution's country of residence for tax purposes?

3

4

Select the Financial Institution's FATCA classification in its country of tax residence (check only one)

Participating Financial Institution not covered by an IGA; or a Reporting Financial Institution under a Model 2 IGA

Registered Deemed-Compliant Financial Institution (including a Reporting Financial Institution under a Model 1 IGA)

Limited Financial Institution

None of the above

5

Mailing Address of Financial Institution

Country

Address Line 1

Address Line 2

City

State/Province/Region

ZIP/Postal Code

6

Indicate whether the Financial Institution has in effect a withholding agreement with the IRS to be treated as one of the following:

a

Qualified Intermediary (QI)

Provide QI EIN:

Does the Financial Institution intend to maintain its status as a QI?

Yes

No

b

Withholding Foreign Partnership (WP)

Provide WP EIN:

Does the Financial Institution intend to maintain its status as a WP?

Yes

No

c

Withholding Foreign Trust (WT)

Provide WT EIN:

Does the Financial Institution intend to maintain its status as a WT?

Yes

No

d

Not applicable

8957

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 37778V

Form

(8-2013)

1

1 2

2 3

3 4

4