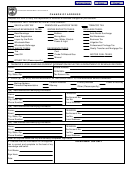

Form ADD-CH Instructions

Change of Address

General Information

Additional Information

If you moved after you filed your tax return and you are

Use the Additional Information field for “In Care-Of” name

expecting a refund, notify the department as soon as

or other supplemental address information only.

possible to make sure we mail your check to the new

PO Box

address.

If your post office does not deliver mail to your street

Complete this form only if you file any of the following

address, list your PO Box number instead of your street

individual income tax returns: Forms 2, 2EZ or 2EC.

address.

This form permanently changes your mailing address with

Foreign Address

the department. If your mailing address changes again,

complete this form or provide the new address on your next

If you have a foreign address, follow the country’s practice

tax return.

for entering the city, county, province, state, country and

postal code, as applicable, in the appropriate boxes. Do not

This form is optional. File this form at any time to alert the

abbreviate the country name.

department to your change of address. Do not attach this

form to your tax return.

Verify Your Identity

If you file using the filing status married filing separately,

Provide a copy of a valid photo ID and provide a copy of a

complete a separate form for each spouse.

piece of mail that shows your current mailing address (e.g.,

Purpose

a utility bill). If you file a joint return, provide identification

for both spouses.

Use Form ADD-CH, Change of Address, to change

your home mailing address. We will use only the new

Signature

mailing address for future correspondence. Generally,

You must sign in the space provided. If you filed a joint tax

complete only one Form ADD-CH to change your home

return and this change of address is also for your spouse,

address. If this change also affects the mailing address

your spouse must also sign the form.

for your children who filed separate tax returns, complete

a separate Form ADD-CH for each child. If you are a

Where to File

representative filing for the taxpayer, go to revenue.mt.gov

Send this form and proof of address change through one of

and search for POA.

these options.

Name and Address

Mail:

Enter your first name, middle initial, last name, social

MONTANA DEPARTMENT OF REVENUE

security number (SSN) or individual taxpayer identification

PO BOX 5805

number (ITIN), and address in the spaces provided. If a

HELENA MT 59601-5805

joint tax return, enter the name and SSN of your spouse.

Fax:

Prior Name(s)

406-444-7723

If you or your spouse changed your name because of

Attn Registration

marriage, divorce, etc., enter the prior last name only in the

Secure Messaging:

“Prior Name(s)” field.

TransAction Portal TAP

https://tap.dor.mt.gov

Log into your tax account to

Send us a message

1

1 2

2