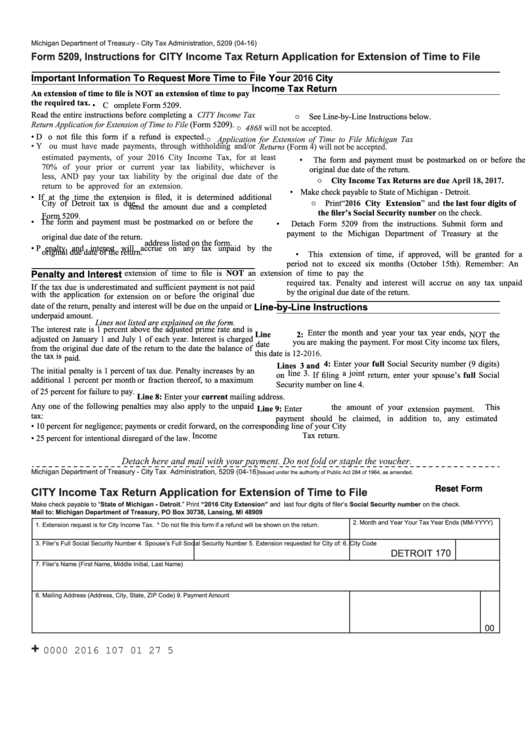

Michigan Department of Treasury - City Tax Administration, 5209 (04-16)

Form 5209, Instructions for CITY Income Tax Return Application for Extension of Time to File

Important Information

To Request More Time to File Your

2016

City

Income Tax Return

An extension of time to file is NOT an extension of time to pay

the required tax.

• C omplete Form 5209.

Read the entire instructions before completing a

CITY Income Tax

○ See Line-by-Line Instructions below.

Return Application for Extension of Time to File

(Form 5209).

○ U.S. form 4868 will not be accepted.

• D o not file this form if a refund is expected.

○ Application for Extension of Time to File Michigan Tax

• Y ou must have made payments, through withholding and/or

Returns (Form 4) will not be accepted.

estimated payments, of your 2016 City Income Tax, for at least

• The form and payment must be postmarked on or before the

70% of your prior or current year tax liability, whichever is

original due date of the return.

less, AND pay your tax liability by the original due date of the

○ City Income Tax Returns are due

April 18, 2017.

return to be approved for an extension.

• Make check payable to State of Michigan - Detroit.

• If at the time the extension is filed, it is determined additional

○ Print

“2016

City Extension” and the last four digits of

City of Detroit tax is due, send the amount due and a completed

the filer’s Social Security number on the check.

Form 5209.

• Detach Form 5209 from the instructions. Submit form and

• The form and payment must be postmarked on or before the

payment to the Michigan Department of Treasury at the

original due date of the return.

address listed on the form.

• P enalty and interest will accrue on any tax unpaid by the

• This extension of time, if approved, will be granted for a

original due date of the return.

period not to exceed six months (October 15th). Remember: An

extension of time to file is NOT an extension of time to pay the

Penalty and Interest

required tax. Penalty and interest will accrue on any tax unpaid

If the tax due is underestimated and sufficient payment is not paid

by the original due date of the return.

with the application for extension on or before the original due

date of the return, penalty and interest will be due on the unpaid or

Line-by-Line Instructions

underpaid amount.

Lines not listed are explained on the form.

The interest rate is 1 percent above the adjusted prime rate and is

Line 2: Enter the month and year your tax year ends, NOT the

adjusted on January 1 and July 1 of each year. Interest is charged

date you are making the payment. For most City income tax filers,

from the original due date of the return to the date the balance of

this date is 12-2016.

the tax is paid.

Lines 3 and 4: Enter your full Social Security number (9 digits)

The initial penalty is 1 percent of tax due. Penalty increases by an

on line 3. If filing a joint return, enter your spouse’s full Social

additional 1 percent per month or fraction thereof, to a maximum

Security number on line 4.

of 25 percent for failure to

pay.

Line 8: Enter your current mailing address.

Any one of the following penalties may also apply to the unpaid

Line 9: Enter the amount of your extension payment. This

tax:

payment should be claimed, in addition to, any estimated

• 10 percent for negligence;

payments or credit forward, on the corresponding line of your City

Income Tax return.

• 25 percent for intentional disregard of the law.

Detach here and mail with your payment. Do not fold or staple the voucher.

Michigan Department of Treasury - City Tax Administration, 5209 (04-16)

Issued under the authority of Public Act 284 of 1964, as amended.

CITY Income Tax Return Application for Extension of Time to File

Reset Form

Make check payable to “State of Michigan - Detroit.” Print “2016 City Extension” and last four digits of filer’s Social Security number on the check.

Mail to: Michigan Department of Treasury, PO Box 30738, Lansing, MI 48909

2. Month and Year Your Tax Year Ends (MM-YYYY)

1. Extension request is for City Income Tax.

* Do not file this form if a refund will be shown on the return.

3. Filer’s Full Social Security Number

4. Spouse’s Full Social Security Number

5. Extension requested for City of:

6. City Code

DETROIT

170

7. Filer’s Name (First Name, Middle Initial, Last Name)

8. Mailing Address (Address, City, State, ZIP Code)

9. Payment Amount

00

+

0000 2016 107 01 27 5

1

1