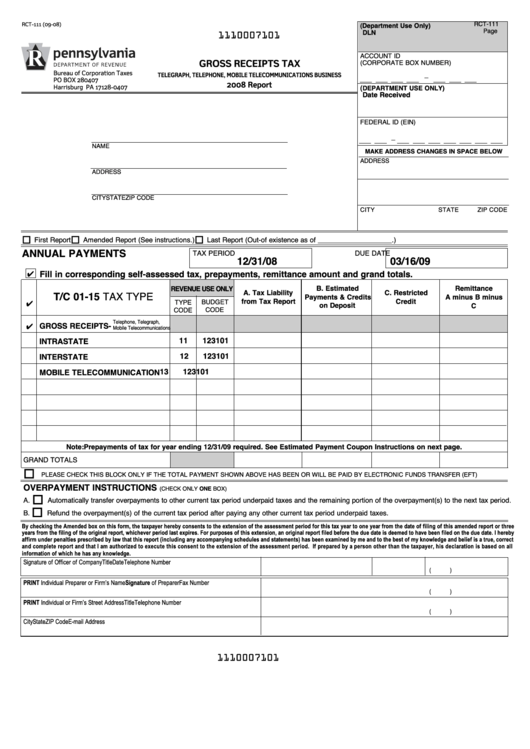

Form Rct-111 - Gross Receipts Tax - Pennsylvania Department Of Revenue - 2008

ADVERTISEMENT

RCT-111 (09-08)

RCT-111

(Department Use Only)

Page

DLN

1110007101

ACCOUNT ID

GROSS RECEIPTS TAX

(CORPORATE BOX NUMBER)

Bureau of Corporation Taxes

TELEGRAPH, TELEPHONE, MOBILE TELECOMMUNICATIONS BUSINESS

_

PO BOX 280407

2008 Report

Harrisburg PA 17128-0407

(

DEPARTMENT USE ONLY)

Date Received

FEDERAL ID (EIN)

_

NAME

MAKE ADDRESS CHANGES IN SPACE BELOW

ADDRESS

ADDRESS

CITY

STATE

ZIP CODE

CITY

STATE

ZIP CODE

First Report

Amended Report (See instructions.)

Last Report (Out-of existence as of ___________________.)

ANNUAL PAYMENTS

TAX PERIOD

DUE DATE

12/31/08

03/16/09

Fill in corresponding self-assessed tax, prepayments, remittance amount and grand totals.

B. Estimated

REVENUE USE ONLY

Remittance

A. Tax Liability

C. Restricted

T/C 01-15 TAX TYPE

Payments & Credits

A minus B minus

from Tax Report

Credit

BUDGET

TYPE

on Deposit

C

CODE

CODE

Telephone, Telegraph,

GROSS RECEIPTS-

Mobile Telecommunications

11

123101

INTRASTATE

12

123101

INTERSTATE

13

123101

MOBILE TELECOMMUNICATION

Note: Prepayments of tax for year ending 12/31/09 required. See Estimated Payment Coupon Instructions on next page.

GRAND TOTALS

PLEASE CHECK THIS BLOCK ONLY IF THE TOTAL PAYMENT SHOWN ABOVE HAS BEEN OR WILL BE PAID BY ELECTRONIC FUNDS TRANSFER (EFT)

OVERPAYMENT INSTRUCTIONS

(CHECK ONLY ONE BOX)

A.

Automatically transfer overpayments to other current tax period underpaid taxes and the remaining portion of the overpayment(s) to the next tax period.

B.

Refund the overpayment(s) of the current tax period after paying any other current tax period underpaid taxes.

By checking the Amended box on this form, the taxpayer hereby consents to the extension of the assessment period for this tax year to one year from the date of filing of this amended report or three

years from the filing of the original report, whichever period last expires. For purposes of this extension, an original report filed before the due date is deemed to have been filed on the due date. I hereby

affirm under penalties prescribed by law that this report (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is a true, correct

and complete report and that I am authorized to execute this consent to the extension of the assessment period. If prepared by a person other than the taxpayer, his declaration is based on all

information of which he has any knowledge.

Signature of Officer of Company

Title

Date

Telephone Number

(

)

PRINT Individual Preparer or Firm’s Name

Signature of Preparer

Fax Number

(

)

PRINT Individual or Firm’s Street Address

Title

Telephone Number

(

)

City

State

ZIP Code

E-mail Address

1110007101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1